Belgian employers plan to slow down hiring during the second quarter of 2024

Belgium moves up five places in ManpowerGroup’s 2023 Total Workforce Index™

13 February 2024

7 simple actions to protect the planet!

10 June 2024According to the ManpowerGroup Employment Outlook Survey, hiring prospects are deteriorating in 39 out of 42 surveyed countries on a quarterly comparison basis, amid uncertainty.

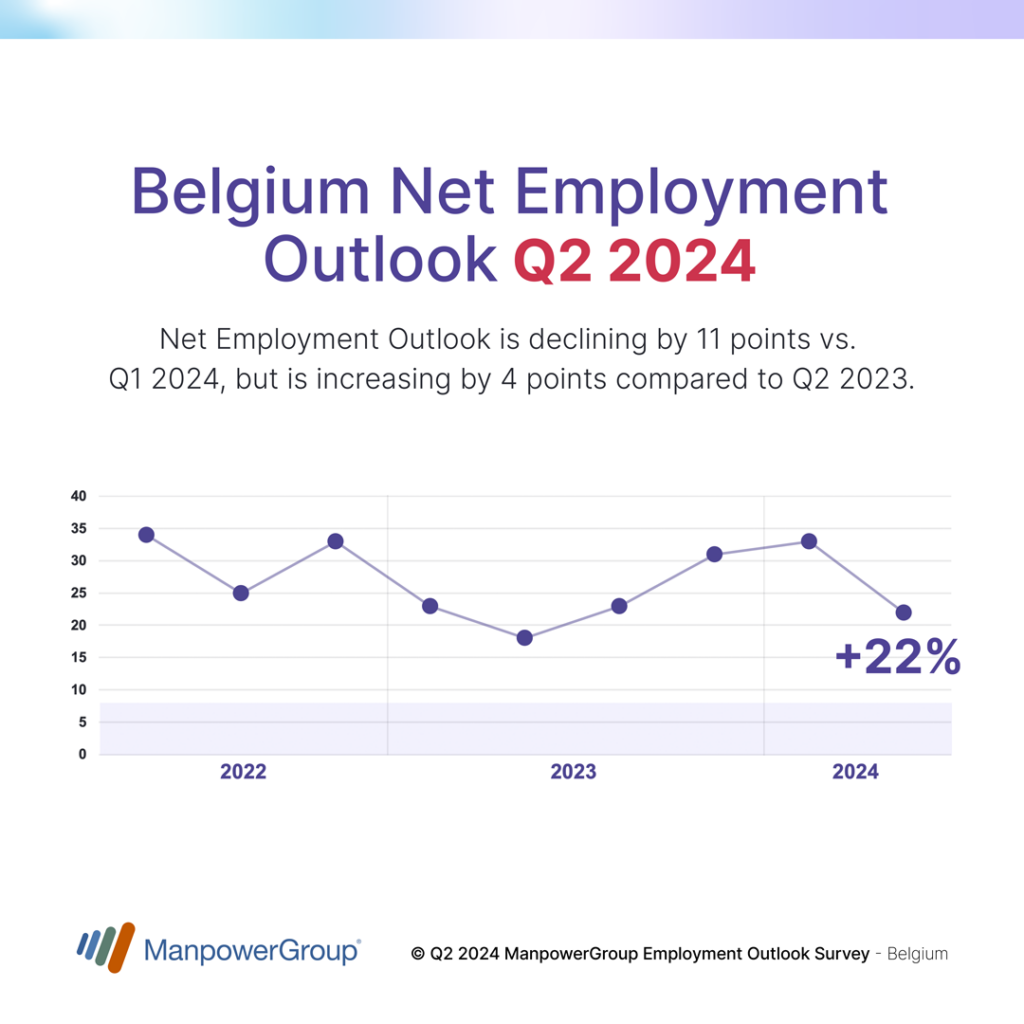

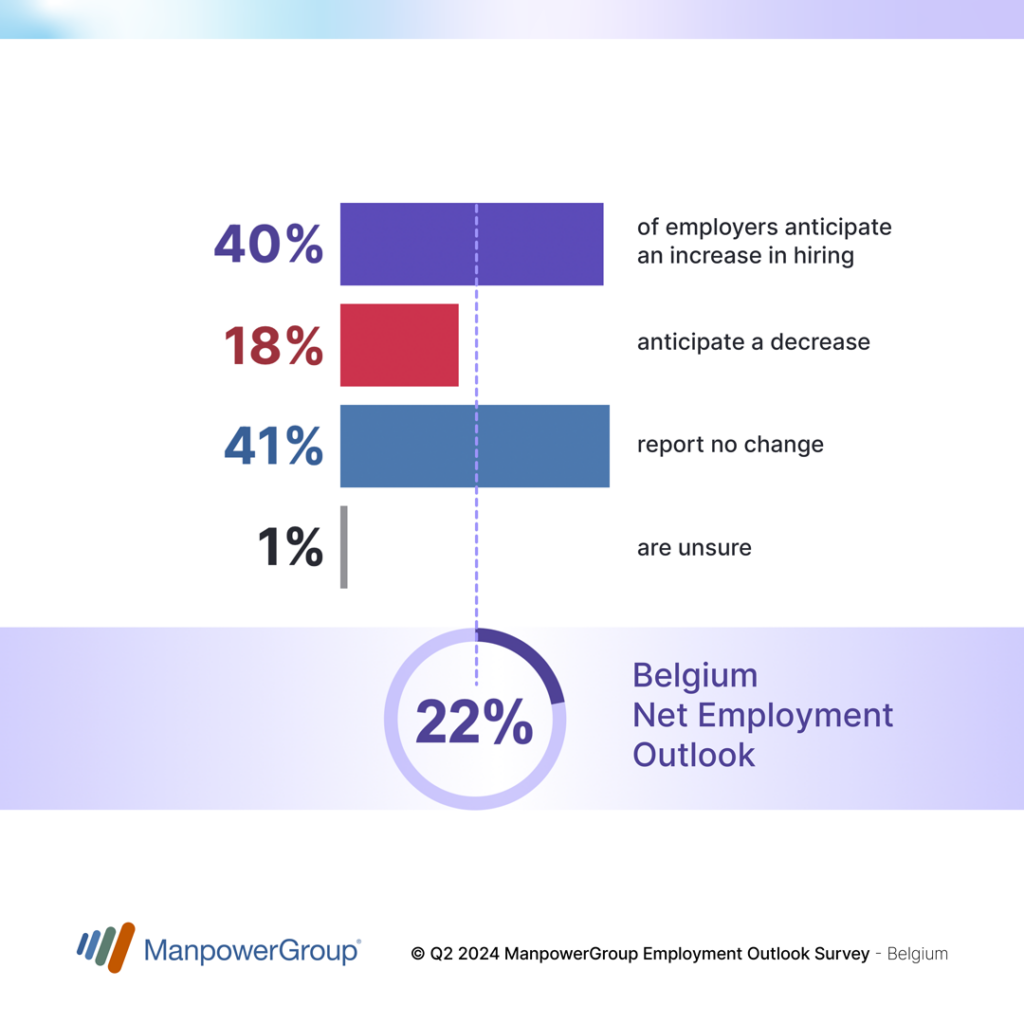

According to the ManpowerGroup Employment Outlook Survey released today, job opportunities are expected to reduce over the next three months in Belgium and worldwide. In fact, out of the 525 employers surveyed in January by ManpowerGroup, 40% plan to increase their workforce by the end of June 2024, while 18% plan to reduce headcount. 41% of the surveyed employers anticipate no change. After seasonal adjustment, the Net Employment Outlook(1) – – or the difference between the percentage of employers anticipating hiring and the percentage anticipating layoffs – stands at a moderate value of +22%. This marks a significant decrease of 11 points compared to the previous quarter, but an increase of 4 points compared to the same period last year.

“Given the prevailing uncertainty, Belgian employers, like the majority of their counterparts surveyed by ManpowerGroup worldwide, anticipate a slowdown in hiring over the next quarter,” explains Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “Employment is already taking centre stage in the election campaign ahead of the federal, regional, and European elections, due to the persistent skills shortage, the mismatch between available skills and business needs, and the need to make work more attractive than remaining unemployed or inactive . Companies want measures aimed at improving training, increasing employment rates, and stimulating the economy, while faced with increasing challenges related to ecological and digital transition.”

Employer hiring confidence sharply declines in Flanders and Wallonia

The Net Employment Outlook records a significant decrease of 15 points in Flanders and 10 points in Wallonia compared to the previous quarter, standing at +19% and +23%, respectively. The job market is expected to be more dynamic in Brussels, where the Net Employment Outlook increases by 4 points compared to the previous quarter, reaching +31%.

Positive hiring intentions across the nine surveyed sectors

Despite a decline in six sectors compared to the previous quarter, employers in all nine sectors surveyed in Belgium plan to increase their workforce by the end of June 2024.

As in the previous quarter, employers in the Communication Services/Telecoms sector anticipate the most favourable employment prospects (+47%), with more than half of surveyed employers planning to increase staff by the end of June. Forecasts in the Finance and Real Estate sector (+30%) are also significantly above the national average, whilst progressing on a quarterly and annual basis in the Transport, Logistics, and Automotive sector (+25%). According to ManpowerGroup, net job creations are also expected in the following sectors: Consumer Goods/Services/Horeca/Retail (+24%), Industry/Construction/Agriculture & Fishing (+24%), Consumer Goods and Services (24%), Public & Non-profit Services/ Education/Other (+22%), and IT (+18%). However, employers are more pessimistic in the Energy (+10%) and Healthcare/Life Sciences (+5%) sectors.

As for business segments, recruitment activity is expected to be strongest in the segment of companies employing 50-249 workers (+32%).

Hiring slowdown worldwide

Analysis of the results of ManpowerGroup’s survey of 40,000 employers worldwide indicates a decline in employer confidence compared to the previous quarter in 39 of the 42 countries surveyed and in all 24 countries surveyed in the EMEA region (Europe, Middle East, Africa). However, the Net Employment Outlook remains positive in 40 of the 42 countries surveyed. The Outlook stands at +22%, a decrease of 4 percentage points compared to the previous quarter and 2 percentage points compared to the same time last year. The Net Employment Outlook is declining in 27 countries globally year-on-year. Employers in India (+36%) are the most optimistic, while their counterparts in Romania (-2%) are the most pessimistic

With a Net Employment Outlook of +22%, Belgium stands at the same level as the global average, and 7 percentage points stronger than the EMEA average of +15%. Belgium ranks fifth out of 22 European countries, behind the Netherlands (+32%), Switzerland (+29%), Finland (+23%) and the UK (+23%), but ahead of Ireland (+20%), France (+18%), Germany (+17%), Spain (+14%), Poland (+11%), Italy (+9%), Greece (+6%), the Czech Republic (+5%) and Romania (-2%).

Elsewhere in the world, year-on-year hiring prospects are up in the US (+34%) and China (+32%), while they remain weak in Japan (+11%).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 11 June 2024 (Quarter 3 2024).

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. The analysis is based on seasonnlay adjusted data.

Report ManpowerGroup Employment Outlook Survey Q2/2024

Over de ManpowerGroup Employment Outlook Survey

The ManpowerGroup Employment Outlook Survey for the second quarter of 2024 was conducted in January 2024 by interviewing a representative sample of employers from 40,000 private companies and public organizations in 42 countries and territories around the world (including 525 in Belgium). The aim of the survey is to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. All survey participants were asked the same question: “How do you anticipate total employment at your location to change in the three months to the end of June 2024 as compared to the current quarter?” It is the only forward-looking survey of its kind, unparalleled in its size, scope, longevity and area of focus. The Survey has been running for 60 years and is one of the most trusted surveys of employment activity in the world. It is considered a highly respected economic indicator.