Hiring intentions decline amid highly volatile economic conditions (ManpowerGroup Employment Outlook Survey Q3/2025)

For the fifth consecutive year, Manpower Belgium has won the Belgian HR Excellence Award in the category Best Staffing & Sourcing Company!

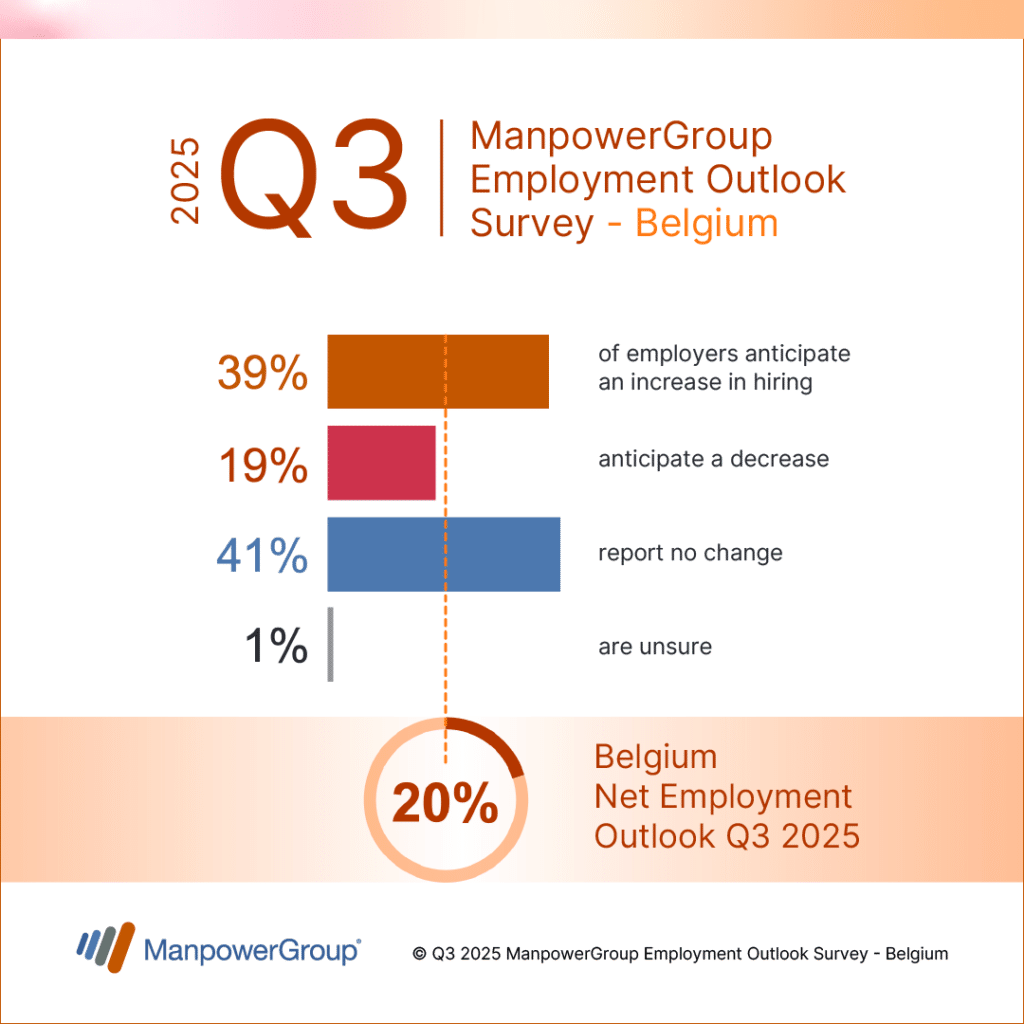

1 April 2025Net Employment Outlook drops to +20% for Q3 2025 – lowest level in two years.

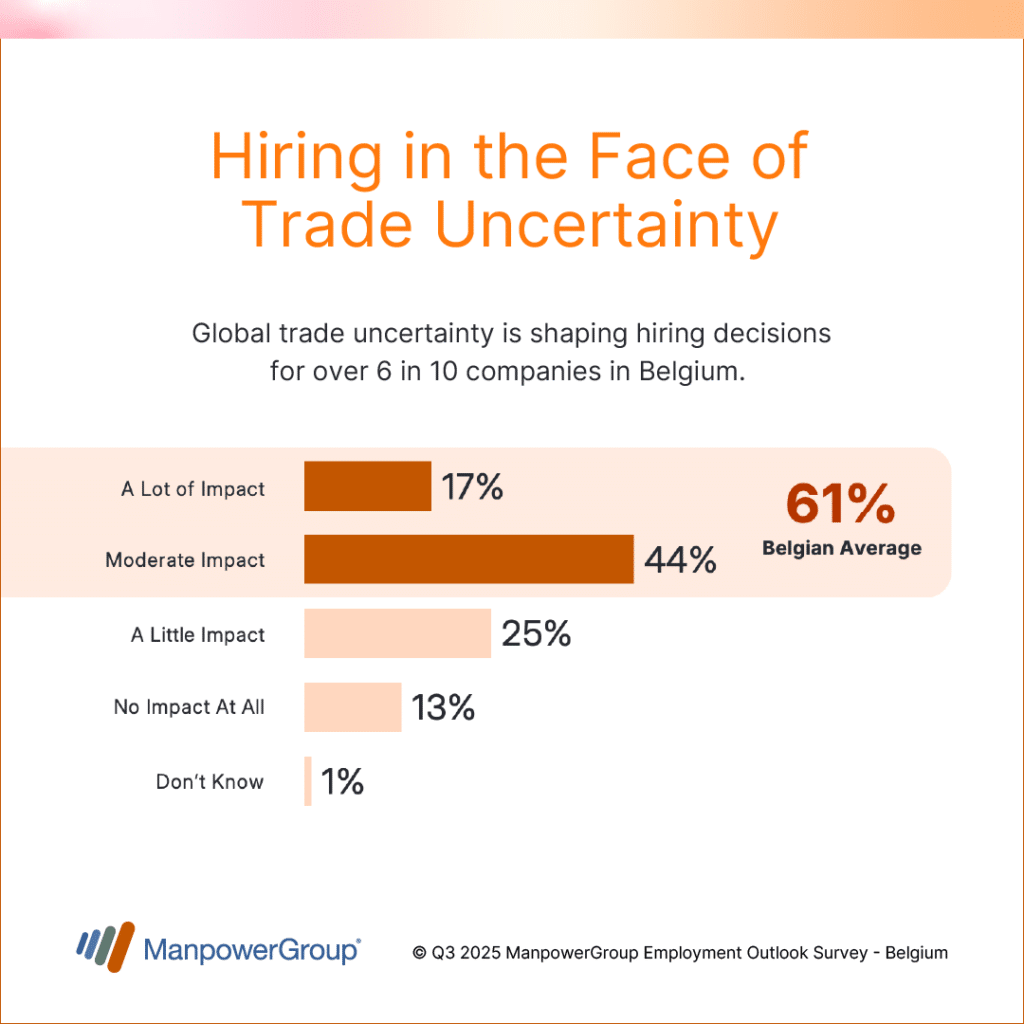

Global trade uncertainty impacts hiring decisions of 6 in 10 employers surveyed in Belgium.

According to the latest ManpowerGroup Employment Outlook Survey released today, Belgian employers anticipate a further slowdown in hiring during the third quarter of 2025. Among the 525 employers surveyed by ManpowerGroup in April, 39% plan to increase staffing levels by the end of September 2025, while 19% expect to reduce headcount. Meanwhile, 41% foresee no change.

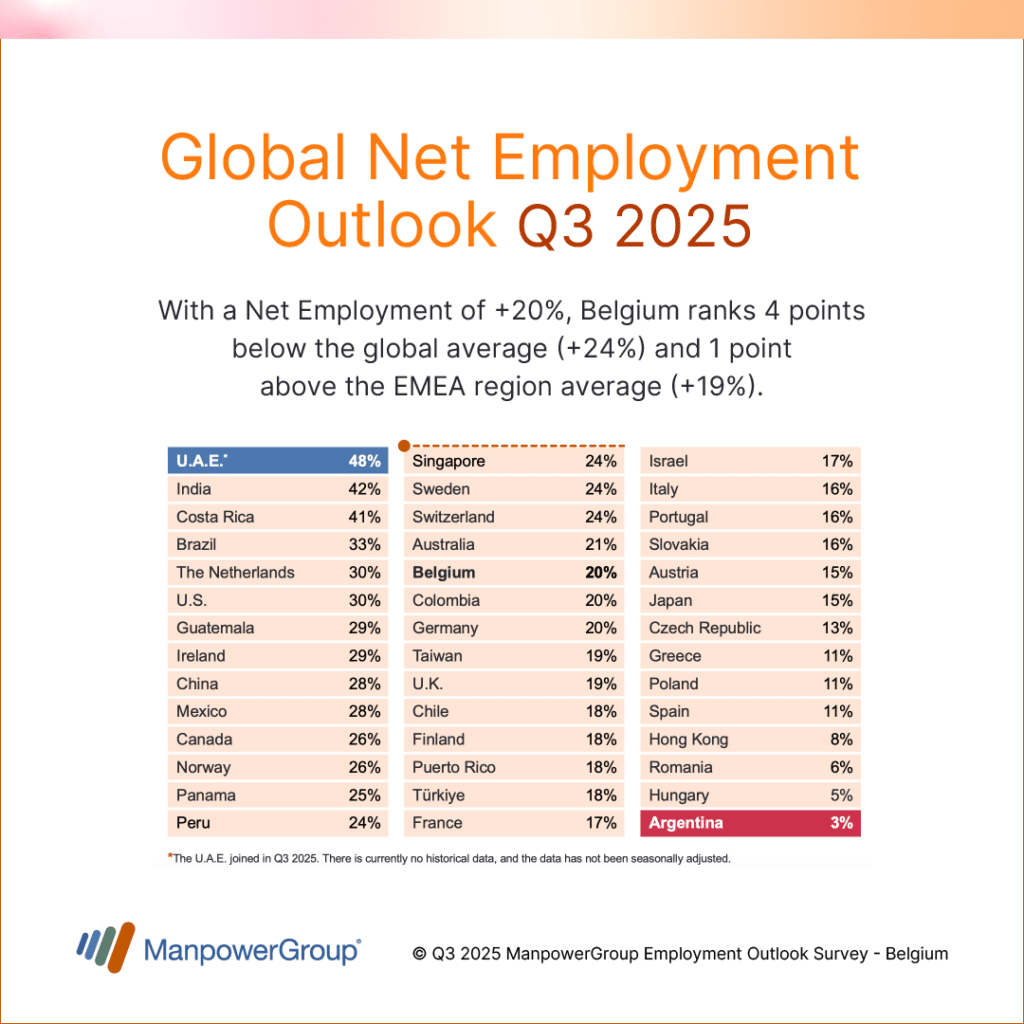

Once seasonal variations are accounted for, the Net Employment Outlook (1) – the difference between the percentage of employers expecting to hire and those anticipating layoffs – stands at +20%, marking a second consecutive quarterly decline and the lowest level since Q2 2023. This represents a drop of 4 percentage points compared to the previous quarter and 5 points year-over-year. With this figure, Belgium ranks 1 point above the EMEA (Europe, Middle East, Africa) average of +19%, and 4 points below the global average of +24%.

“Our survey results show that in today’s highly volatile economic environment, Belgian employers are planning to slow down hiring next quarter: 6 in 10 report that uncertainty related to global trade is directly impacting their recruitment decisions,” explains Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “At the same time, employers are confronting unprecedented workforce changes – demographic shifts, rapid technological advances, and economic pressure – which require them to rethink their strategies, investing more in automation while managing their talent needs more cautiously.”

According to ManpowerGroup data, the mass departure of senior workers from the labour market is directly impacting the HR strategies of more than half of employers (54%), a phenomenon particularly evident in Brussels (62%), Flanders (58%), and Wallonia (47%). In parallel, 54% of Belgian companies say they plan to increase investment in automation over the next 12 months, as job market pressure intensifies in the face of accelerating technological transformations, particularly those linked to artificial intelligence.

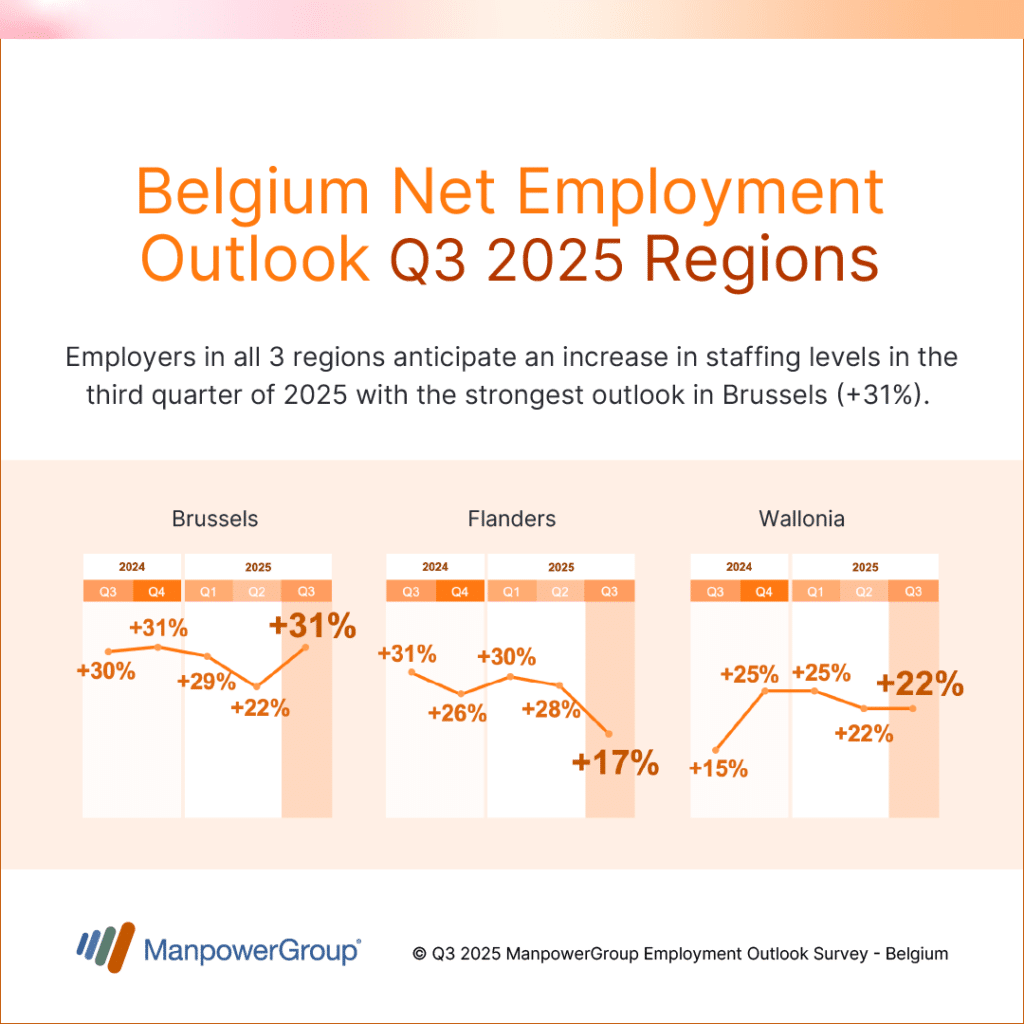

Regional hiring trends vary widely

Employers in all three Belgian regions report positive hiring intentions: +31% in Brussels, +22% in Wallonia,+ 17% in Flanders.

The Net Employment Outlook rose by 9 points in Brussels compared to the previous quarter and remained stable in Wallonia. However, in Flanders, forecasts fell sharply – down 11 points quarter-over-quarter and 14 points year-over-year.

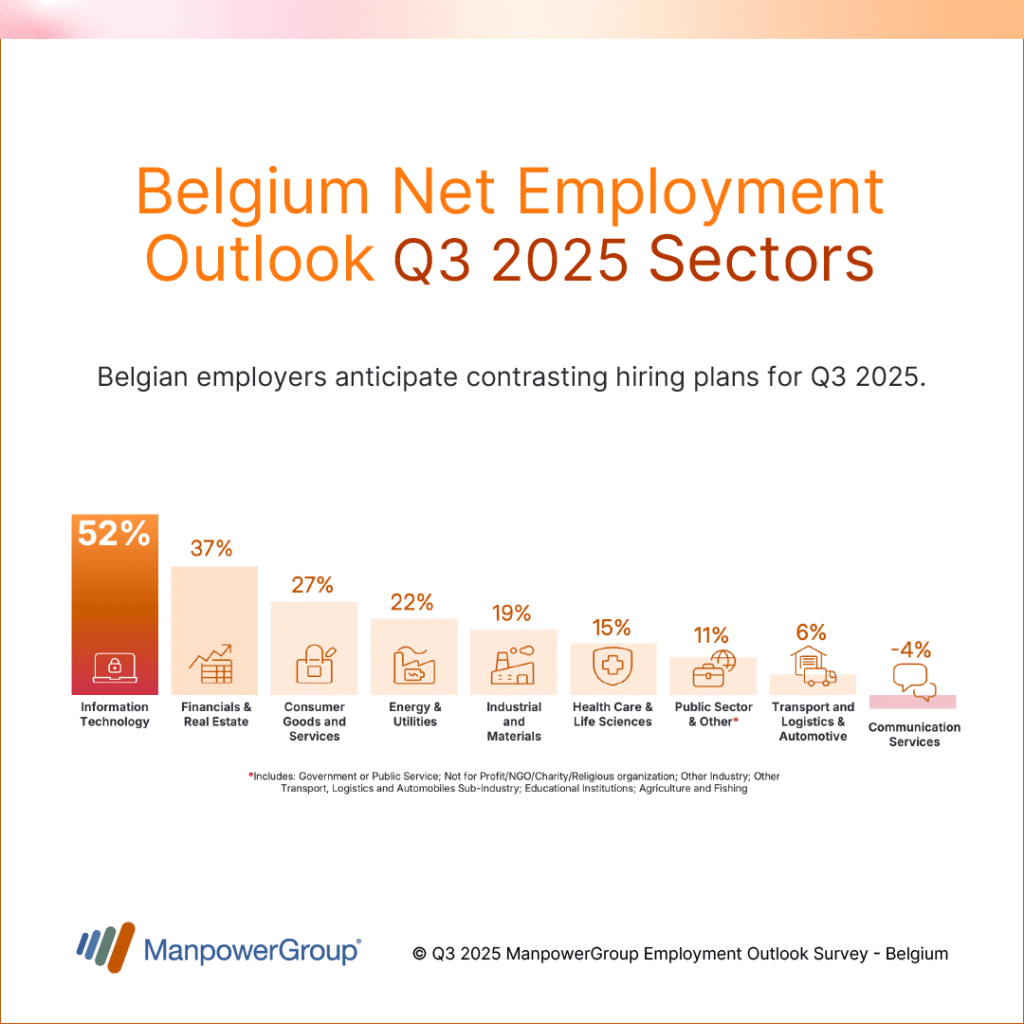

IT sector leads hiring growth

Employers in 8 out of 9 sectors surveyed in Belgium expect to increase staffing levels by the end of September 2025. As in the previous quarter, hiring trends vary significantly by industry.

The most optimistic Outlook is reported in the Information Technology (IT) sector, with a Net Employment Outlook of +52% – more than 6 in 10 IT employers surveyed plan to hire in the next quarter.

Favorable hiring conditions are also expected in Financial & Real Estate Activities (+37%), Consumer Goods, Services, Hospitality and Retail (+27%). In contrast, job opportunities appear more limited in: Manufacturing & Construction (+19%), Healthcare & Life Sciences (+15%), Public Services, Education & Other (+11%), Transport, Logistics & Automotive (+6%). Finally, only the Communication Services sector shows a negative Net Employment Outlook of -4%.

Positive employment outlooks across 42 countries surveyed globally

ManpowerGroup’s global survey of over 40,000 employers reveals positive hiring intentions in all 42 countries surveyed. The global Net Employment Outlook stands at +24%, a relatively stable level for the fourth consecutive quarter. Employers in the United Arab Emirates (+48%) and India (+42%) are the most optimistic, while those in Argentina (+3%) are the most cautious.

The situation is more mixed across the EMEA region, with a Net Employment Outlook of +19%, down 1 point from the previous quarter and stable year-over-year. Hiring expectations declined in 14 of the 23 EMEA countries quarter-over-quarter, and in 13 countries year-over-year.

With a Net Employment Outlook of +20%, Belgium ranks in the upper-middle range among European countries, on par with Germany (+20%). It trails behind the Netherlands (+30%), Ireland (+29%), Sweden (+24%) and Switzerland (+24%), but remains ahead of the UK (+19%), France (+17%), Italy (+16%), Spain (+11%), Poland (+11%), and Hungary (+5%).

Elsewhere, the Net Employment Outlook stands at +30% in the United States, +28% in China, and +15% in Japan.

The results of the next ManpowerGroup Employment Outlook Survey will be released on 9 September 2025 (Quarter 4 2025).

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. The analysis is based on seasonnally adjusted data.

About the Survey

The ManpowerGroup Employment Outlook Survey for the third quarter of 2025 was conducted in April 2025 by interviewing a representative sample of employers from 40,000 private companies and public organizations in 41 countries and territories around the world (including 525 in Belgium). The aim of the survey is to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. All survey participants were asked the same question: “How do you anticipate total employment at your location to change in the three months to the end of September 2025 as compared to the current quarter?” It is the only forward-looking survey of its kind, unparalleled in its size, scope, longevity and area of focus. The Survey has been running for 60 years and is one of the most trusted surveys of employment activity in the world. It is considered a highly respected economic indicator.

Report : ManpowerGroup Employment Outlook Survey Q3 2025