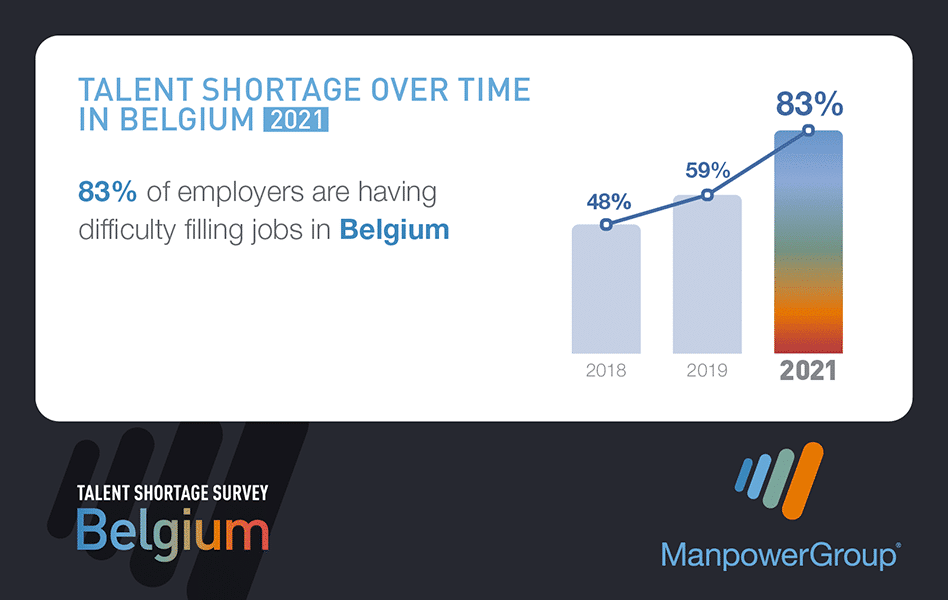

Hiring pace will continue to strengthen during the summer … while 83% of Belgian employers report difficulty filling jobs.

36 % of Belgian companies are accelerating their digitization as a result of the pandemic

18 May 2021

Return to the Workplace: Full-time work onsite and hybrid work on an equal footing

30 June 2021In all three regions, the covid crisis has taken talent shortages to levels not seen in the last 15 years

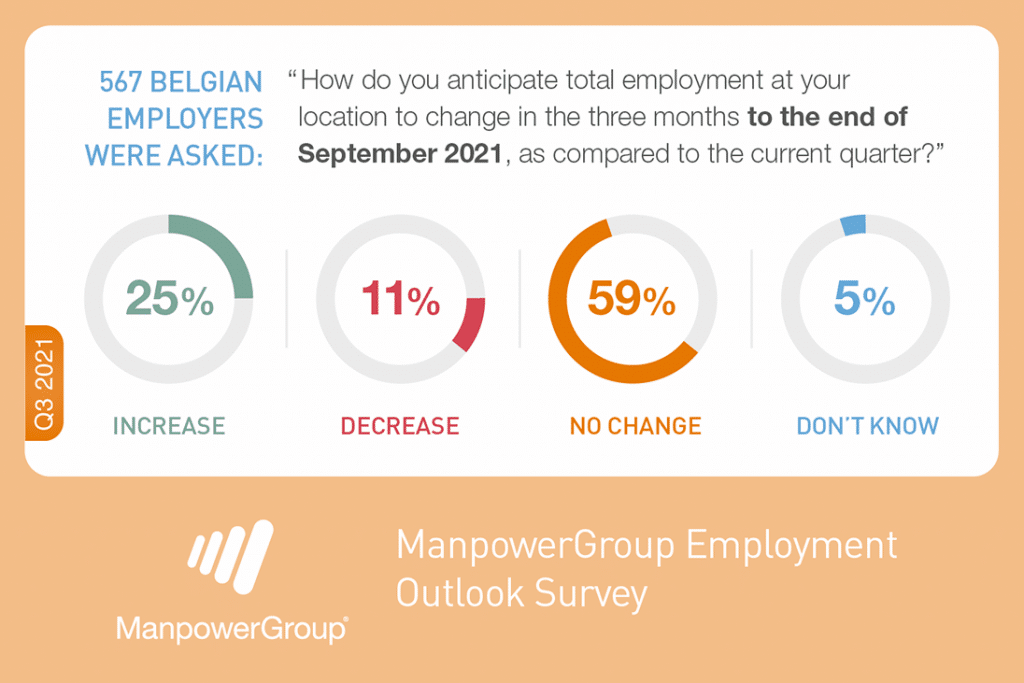

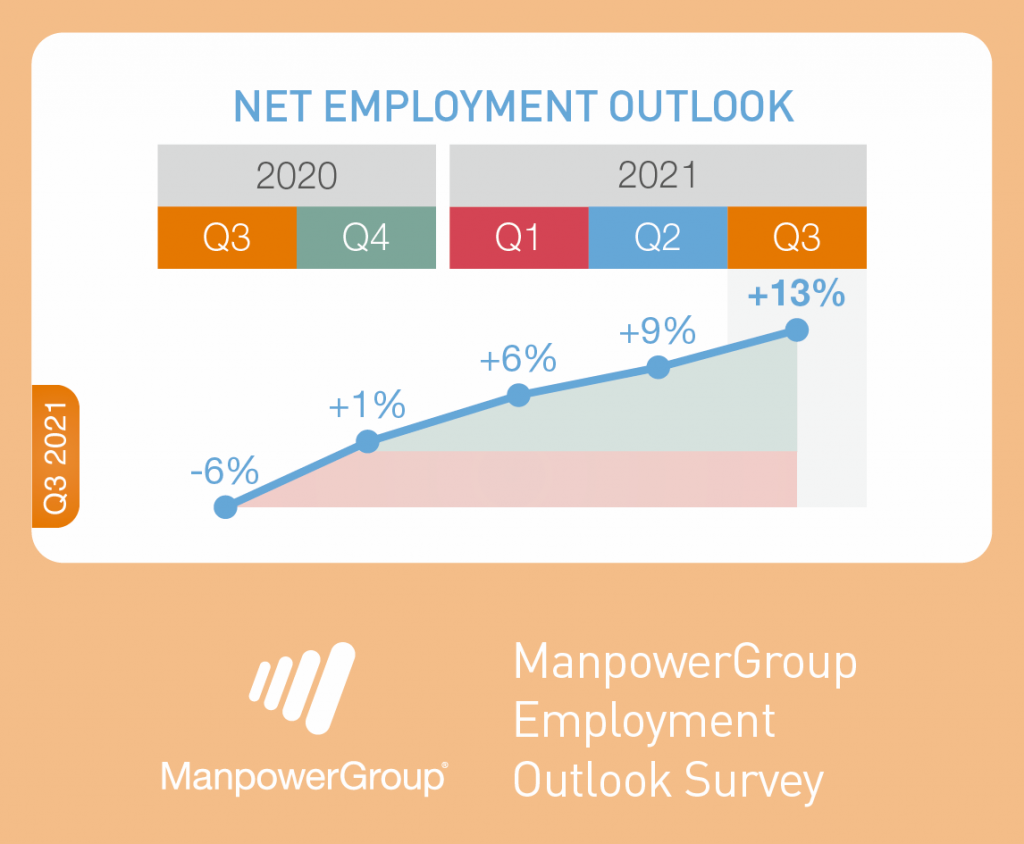

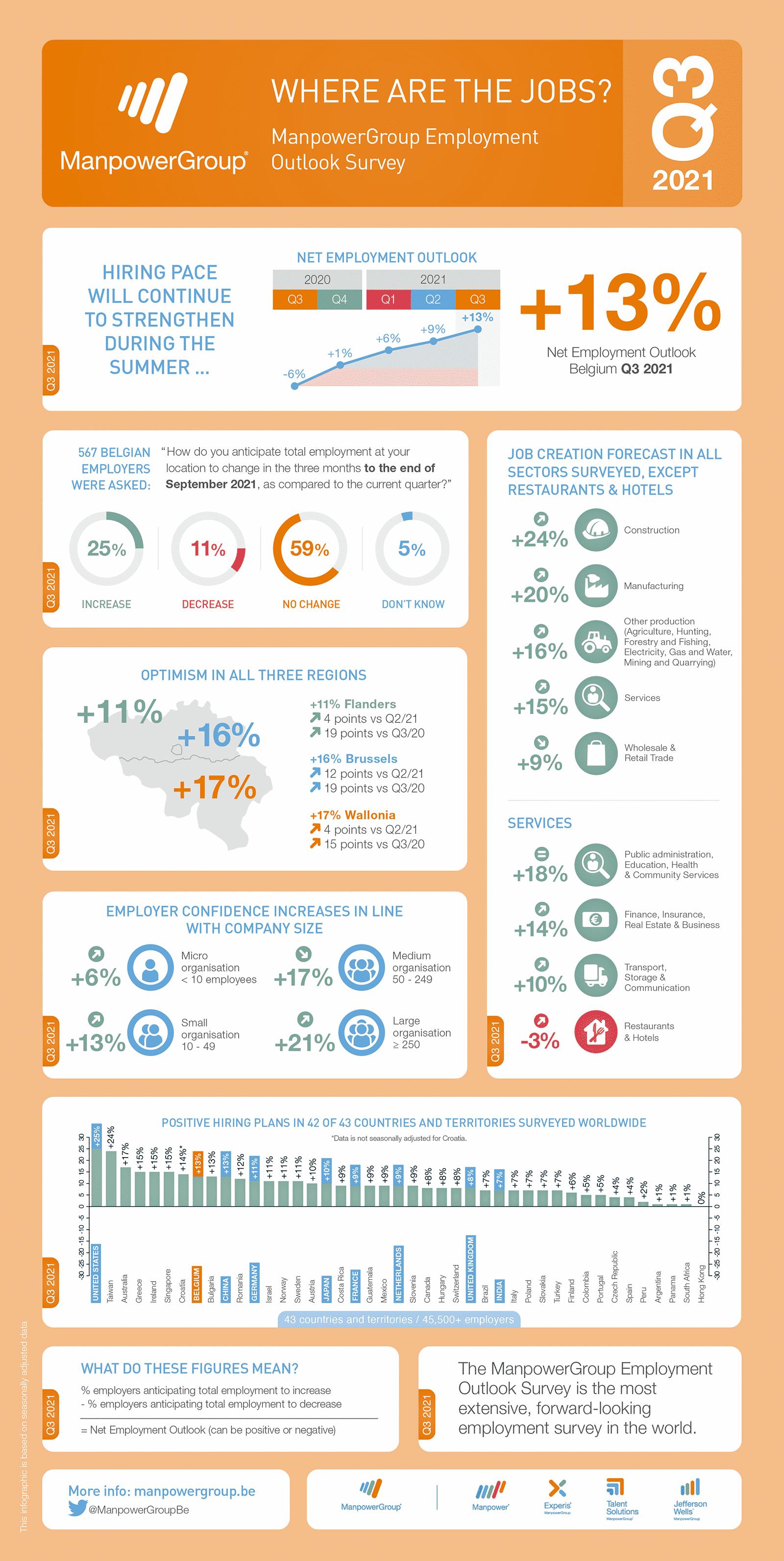

According to the ManpowerGroup Employment Outlook Survey released today, Belgian employers report encouraging hiring intentions for the summer months. No less than 25% of the 567 employers surveyed at the end of April plan to increase their workforce by the end of September 2021, while 11% plan to reduce staff. 59% of employers surveyed are forecasting no change. After seasonal adjustment, the Net Employment Outlook(1) – the difference between the percentage of employers expecting to hire staff and the percentage of those planning to reduce staff – stands at an optimistic value of +13%, up for the fourth consecutive quarter. Hiring intentions improve by 4 points when compared with the previous quarter and by 19 points in comparison with the third quarter fo 2020. According to the ManpowerGroup survey, 55% of Belgian employers surveyed in Belgium expect hiring tempo to return to pre-pandemic levels by the end of January 2022, while 18% of them think that is unlikely.

“The results of our survey confirm the strengthening of employers’ confidence in Belgium and around the world,” says Philippe Lacroix, Managing Director of ManpowerGroup BeLux. “As vaccine rollouts gain momentum and workers prepare to gradually return to their workplaces, employers in all three regions of the country are facing talent shortages never seen before. The covid crisis and the acceleration of digitization have put skills under pressure. At the same time, emerging from the crisis, individuals will be looking for new growth opportunities, a boost to their careers or a new work life balance. Those employers that are responsive to these new needs and can be flexible, will be the ones able to attract and retain the best talent.”

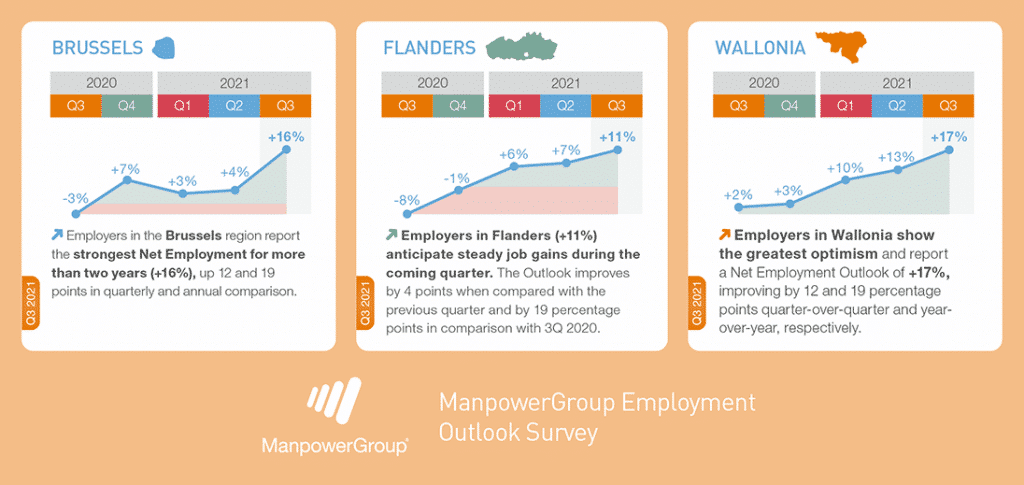

Optimism in all three regions

According to the survey results, the hiring climate will be favorable in all three regions: 17% in Wallonia, + 16% in Brussels (strongest Outlook in more than two years) and + 11% in Flanders. The Net Employment Outlook has improved everywhere, when compared with the previous quarter or with the same period last year.

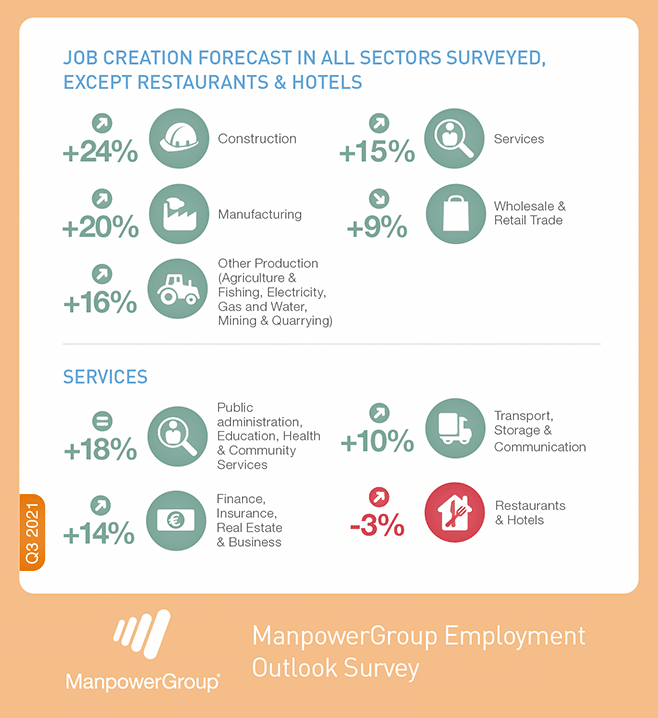

Job gains forecast in all industry sectors surveyed, except Restaurants & Hotels

Payroll additions are anticipated in seven of the eight industry sectors during the third quarter of 2021. For the third consecutive quarter, employers in the Construction sector report the strongest hiring plans (+24%). Job creation will also intensify over the next three months in the Manufacturing sector (+ 20%), up 12 points from the previous quarter to reach its strongest level in 12 years. The hiring climate is also expected to be very favorable in Public services, health, education and social services (+ 18%), the ‘Other production’ sector (+ 16%) – Agriculture & Fishing; Electricity, Gas & Water; Mining & Quarrying industries – as well as in the Finance, insurance, real estate and business services sector (+ 14%). Employers also anticipate payroll gains during the upcoming quarter in Transport and Logistics (+ 10%) and the Wholesale and Retail Trade (+ 9%). Finally, despite a strong increase of 21 points compared to the previous quarter, employment prospects remain slightly negative in the Restaurant and Hotels sector (-3%). “Almost one in five employers plans to lay off staff in the hospitality industry by the end of September, a figure which shows how worrying the employment situation is in this sector”, explains Philippe Lacroix.

Hiring intentions strengthen in seven of the eight industry sectors when compared with the previous quarter and in all sectors when compared with this time one year ago.

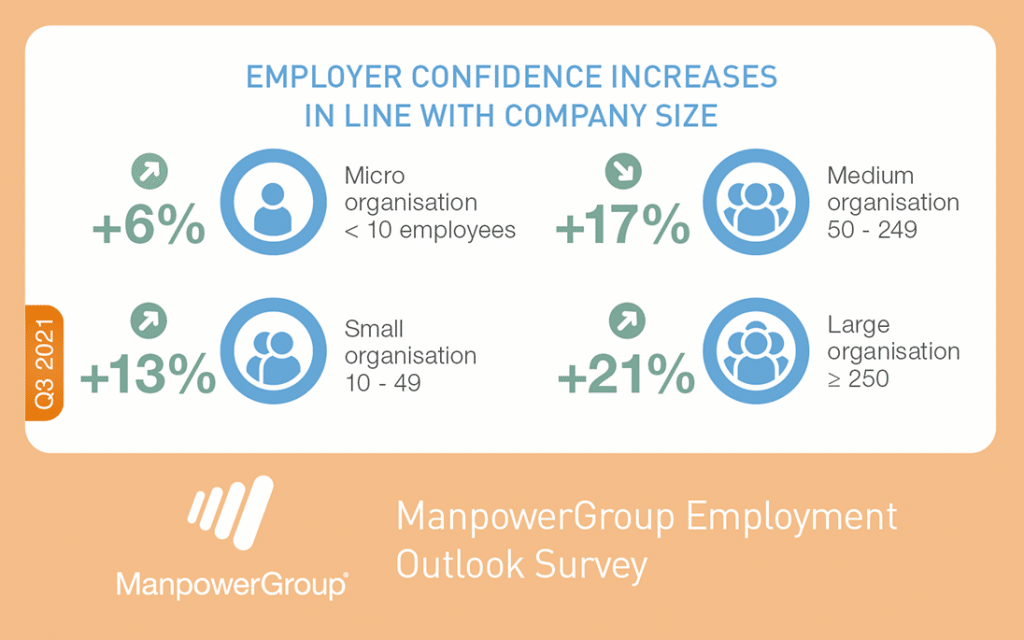

Employer confidence increases in line with company size

According to the ManpowerGroup survey, the Net Employment Outlook shows an increasing value in line with the size of the company: + 6% for Micro businesses (<10 workers), + 13% for Small busineses (10-49 workers), + 17% for medium-sized companies (50-249 workers) and + 21% for large companies (≥ 250 workers).

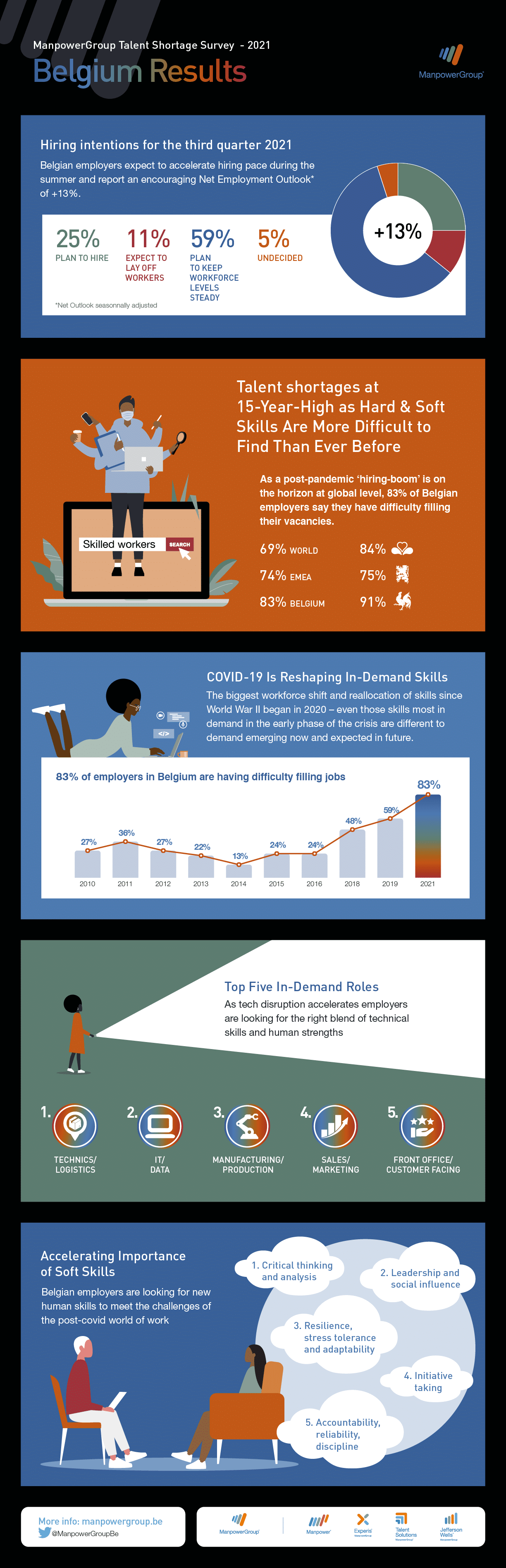

Talent shortages like never before, in all the three regions

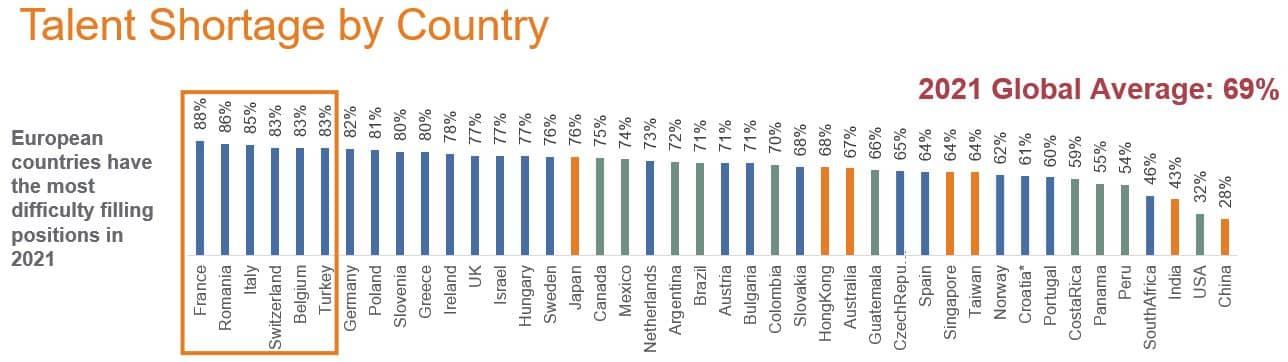

Although labor markets are expected to rebound, employers will face talent shortages never previously seen by ManpowerGroup in 15 years. 83% of Belgian employers surveyed say they have difficulty filling their vacancies, a huge increase of 24 points compared to 2019.

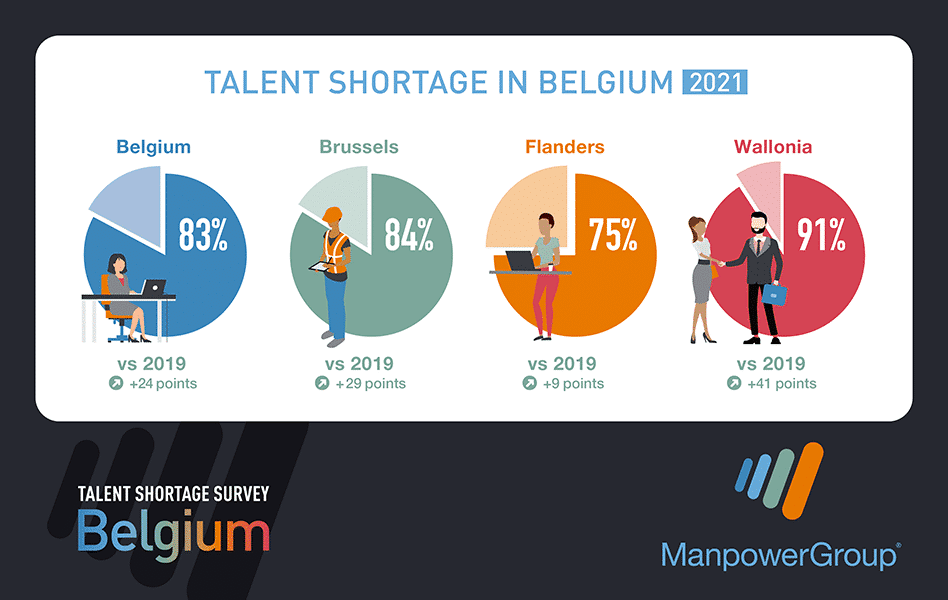

In all three regions, employers cannot find enough candidates or at least, not enough candidates who meet their requirements. Talent shortages affect 91% of employers in Wallonia (up 41 points), 84% in Brussels (up 29 points) and 75% in Flanders (up 9 points).

“As a result of digitization, the Covid crisis has accentuated the polarization of the workforce, with, on the one hand highly qualified candidates with the (digital) skills highly sought after by companies, and on the other hand, profiles that do not have enough technical (hard skills) or interpersonal (soft skills). There is an urgent need on the job market to increase the activity rate(2) of the workforce in Belgium (20-64 years) which, with 70%, remains clearly below the average. European (72%). Ad it start by improving education and training, which must evolve more quickly” explains Philippe Lacroix.

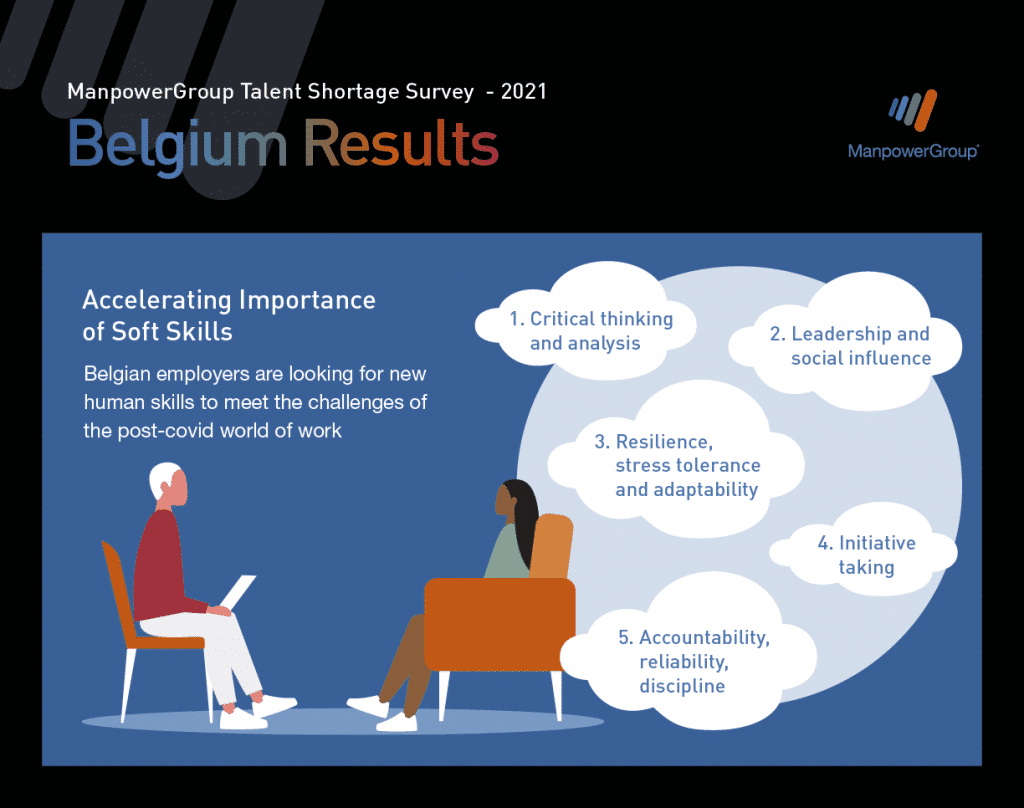

The most difficult hard and soft skills to find

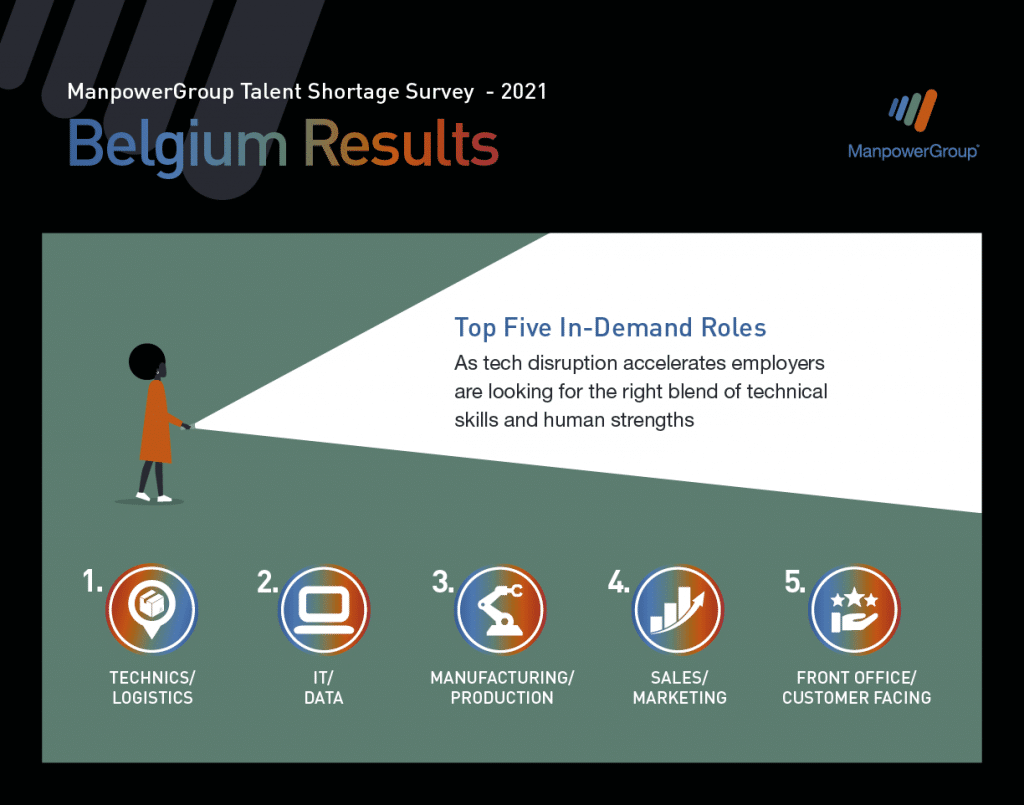

The biggest workforce shift and reallocation of skills since World War II began in 2020 – even those skills most in demand in the early phase of the crisis are different to demand emerging now and expected in future. The survey results unsurprisingly place specialist and digital functions far ahead of generalist functions in the list of the most difficult positions to fill. In descending order, we find Technics/Logistics (38%)– engineers, technicians, skilled trade, logistics workers – IT/Data (19%), Manufacturing/ Production (15%), Sales & Marketing (11%), Front Office/Customer Facing (8%), HR (7%) and Administration/Office Support (5%).

Not only that, but in times of rapid transformation and uncertainty, soft skills have risen in importance and employers have difficulty finding them, particularly critical thinking and analysis (28%), leadership and social influence (26%), resilience, stress tolerance and adaptability (24%), initiative (23%), accountability, reliability and discipline (22%).

A post-pandemic ‘hiring-boom’ on the horizon at global level and an increase in talent shortages

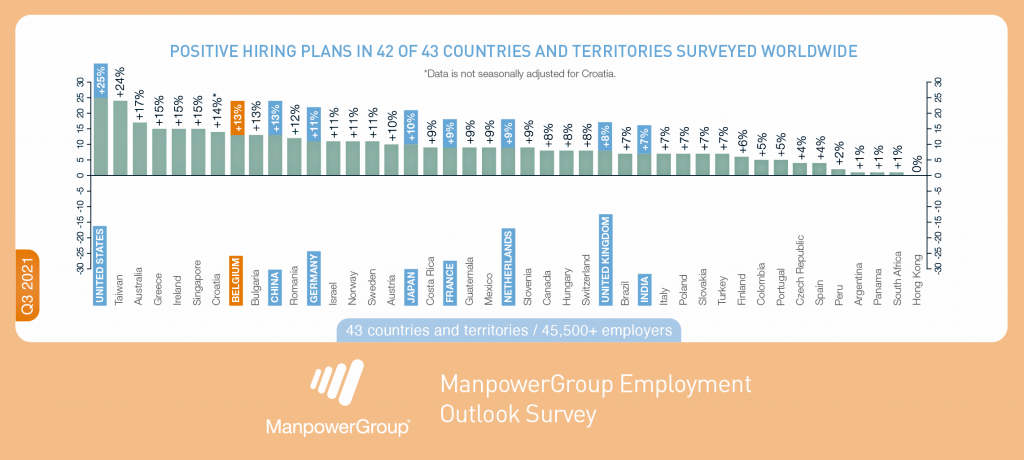

According to ManpowerGroup, who surveyed the hiring intentions of more than 45,000 employers worldwide, a post-pandemic ‘hiring boom’ seems to be on the horizon. Employers anticipate payroll gains in 42 of the 43 countries and report stronger hiring plans in 31 countries. This encouraging trend is also observed in the EMEA region (Europe, Middle East, Africa), with positive recruitment intentions in the 26 countries surveyed, up in 22 of them. The Net Employment Outlook for the third quarter is positive and is improving in all larger economies, in Germany (+11%), in France (+ 9%), in the United Kingdom (+ 8%) and in Italy (+7%), as well as in the Netherlands (+ 9%). Elsewhere in the world, employers report encouraging Outlooks, for example in the United States (+25%), Australia (+17%), China (+13%), Japan (+10%), India (+7 %) or in Brazil (+7%).

Like in Belgium, this improved employment outlook coincides with worsening talent shortages, affecting 69% of employers globally (up 11 points from 2019), and 74% of employers in EMEA (up 13 points).

With 83% of employers experiencing difficulties finding the right talent, Belgium ranks amongst the ten most affected countries, alongside France (88%), Italy (85%), Switzerland (83%), Germany ( 82%), Poland (81%) or Greece (80%). The United Kingdom (77%), Sweden (76%), the Netherlands (73%) and Austria (71%) are above the global average, while employers in Spain (64%), Norway (62%) and Portugal (60%) report levels of shortages below the global and European average. Finally, employers in India (43%), the United States (32%) and China (28%) have less difficulty finding the staff they need.

The results of the next ManpowerGroup Employment Outlook Survey will be released on 14th September 2021 and will report hiring expectations for Q4 2021.

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. Net Employment Outlooks for countries and territories that have accumulated at least 17 quarters of data are reported in a seasonally adjusted format unless otherwise stated. Seasonally adjusted data are not available for Croatia.

Brochure ManpowerGroup Survey Q3/2021

Infographic ManpowerGroup Employment Outlook Survey

Infographic ManpowerGroup Talent Shortage Survey 2021