Belgian employers report cautiously optimistic hiring plans for Q3, according to the ManpowerGroup Employment Outlook Survey

Belgian employers refine strategies to address talent shortages

16 May 2023

ManpowerGroup to unveil the latest HR trends and innovations at VivaTech 2023

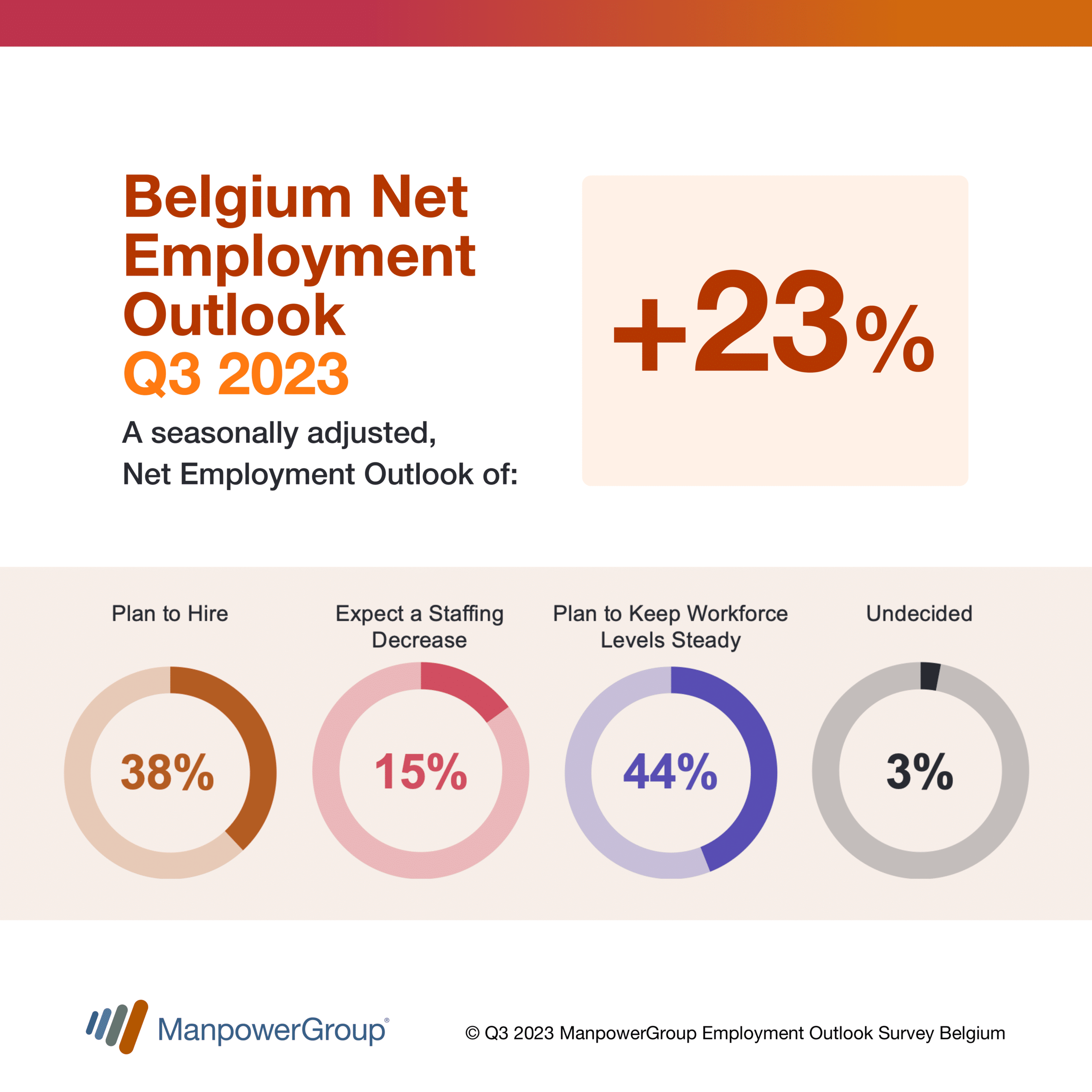

13 June 2023After declining for two quarters in a row, the Net Employment Outlook improves by 5 percentage points to +23%, but is weaker than at the same time last year (+25%).

According to the ManpowerGroup Employment Barometer published today, Belgian employers anticipate a positive hiring climate during Q3 2023, although they will remain cautious. Of the 510 employers surveyed by ManpowerGroup at the end of April, 38% plan to increase their workforce by the end of September 2023, while 15% plan to reduce their headcount. 44% of employers surveyed anticipate no change. After seasonal adjustment, the Net Employment Outlook(2) – or the difference between the percentage of employers anticipating hires and the percentage anticipating reductions in their staffing levels – stands at a positive +23%. This is an increase of 5 percentage points from the previous quarter but a decrease of 2 percentage points in comparison with the 3rd Quarter 2022.

“Belgian employers are cautiously optimistic in their hiring forecasts for the coming quarter,” explains Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “Whilst there is little visibility in the short to medium term, the employers we surveyed clearly indicated their intention to maintain headcounts at the same level (44%), or to create new jobs (38%) during the summer, even though the Net Employment Outlook is below the level achieved at the same time last year. Our labour market remains resilient, as companies continue to struggle with inflation, the impact of salary indexation on their cost structure, and an environment that is still challenging for business – particularly due to the war in Ukraine – and is weighing on their hiring decisions. Employers also continue to face unprecedented talent shortages – more than 4 out of 5 Belgian employers are finding it difficult to fill their vacancies(2) – and are obliged to anticipate the future by strengthening their agility and transformation in a context of international competition”.

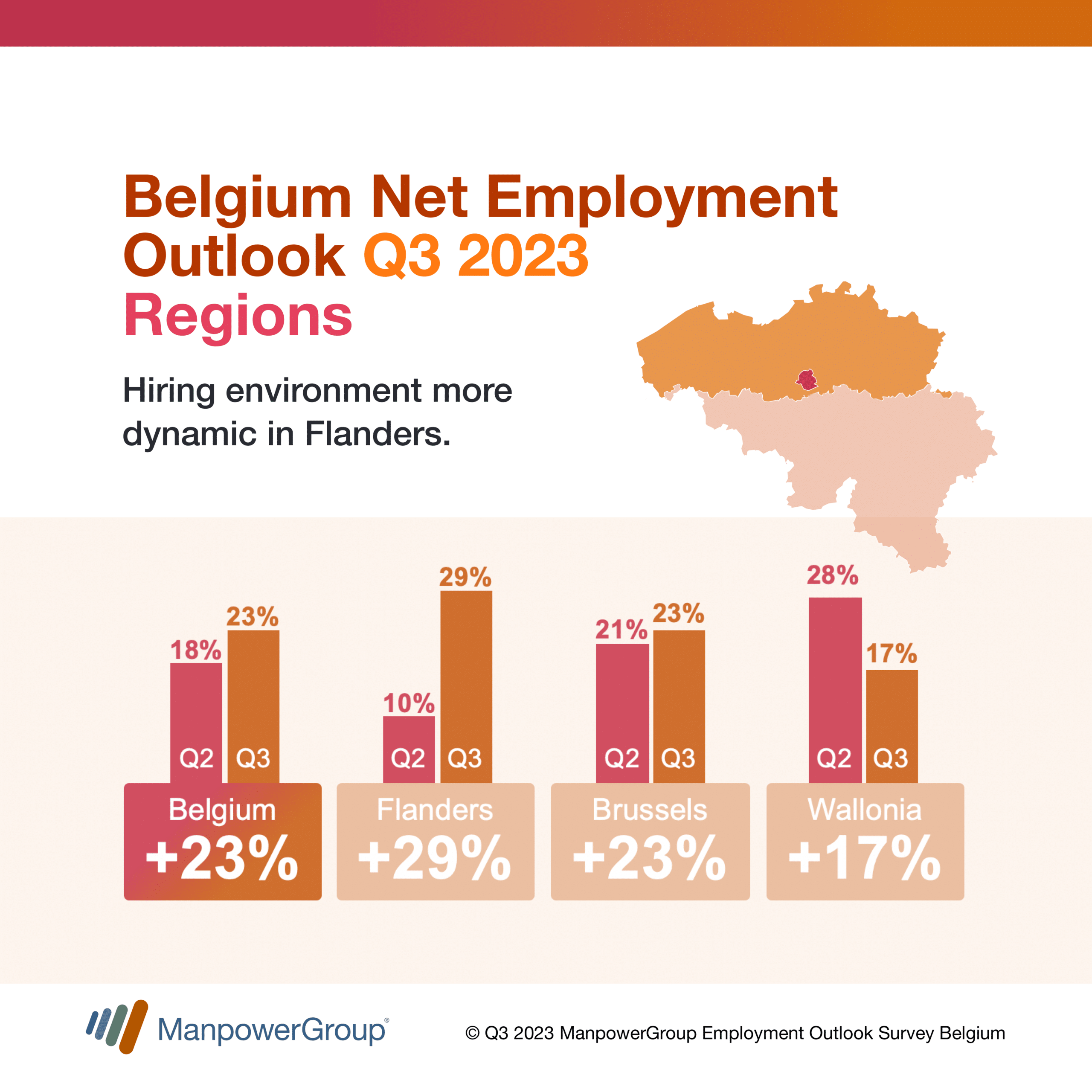

Hiring environment more dynamic in Flanders

Employers in all three regions of the country report positive hiring intentions for the forthcoming quarter. The hiring climate is expected to be strongest in Flanders, where the Net Employment Outlook stands at +29%, the highest level since the 2nd Quarter 2022. The trend is also upwards in Brussels, where the Net Employment Outlook stands at +23%. In contrast, employers in Wallonia report a decline in hiring intentions, reporting a Net Employment Outlook of +18%, 11 percentage points weaker than in the previous quarter.

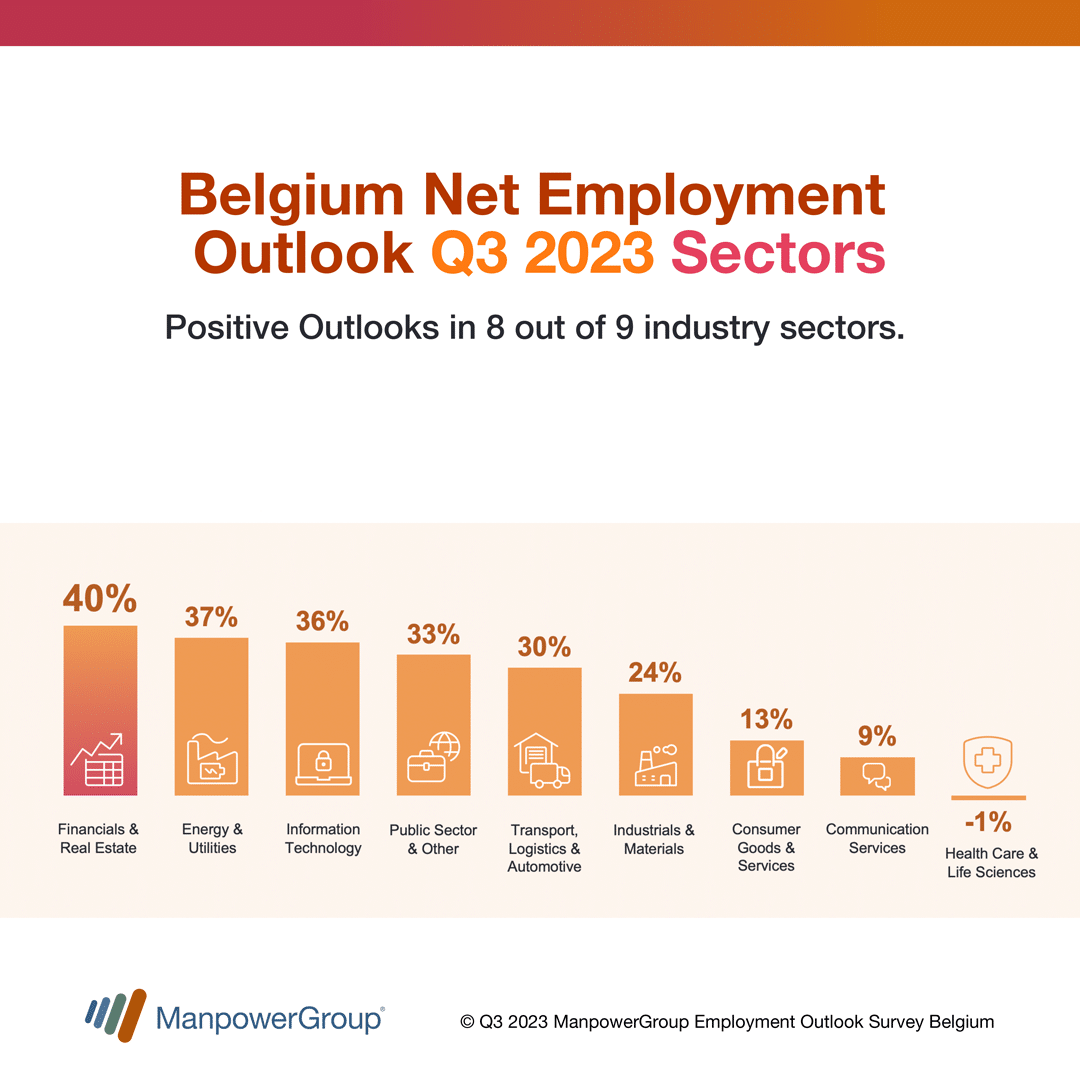

Positive Outlooks in 8 out of 9 industry sectors

Employers in 8 of the 9 sectors surveyed are planning to create new jobs between now and the end of September. “As our recent Talent Shortage Survey(2) showed, employers in all sectors are finding it difficult to find the skills they need, especially digital talent and candidates with the right personal skills,” explains Sébastien Delfosse.

Employers in the Finance & Real Estate sector (+40%) anticipate the strongest hiring activity – with one in two employers planning new jobs – followed by employers in the Energy (+37%) and IT (+36%) sectors. Job prospects are also encouraging in the other sectors : Public Services/Education/Other sectors (+33%), Transport/Logistics/Automotive (+30%) and, to a lesser extent, Manufacturing/ Construction/Agriculture & Fishing (+24%). Conversely, the weakest hiring intentions are reported by employers in the Consumer Goods/Services/Horeca/Retail sector (+13%), the Communication Services sector (+9%) and the Healthcare/Life Sciences sector, which is the only sector to report a slightly negative Outlook (-1%).

Compared to Q2 2023, staffing climates have strengthened in 6 of 9 sectors and weakened in 3 sectors. Looking back to this time last year, job markets have weakened in 5 out of 8 sectors for which we have data, and strengthened in 3 sectors.

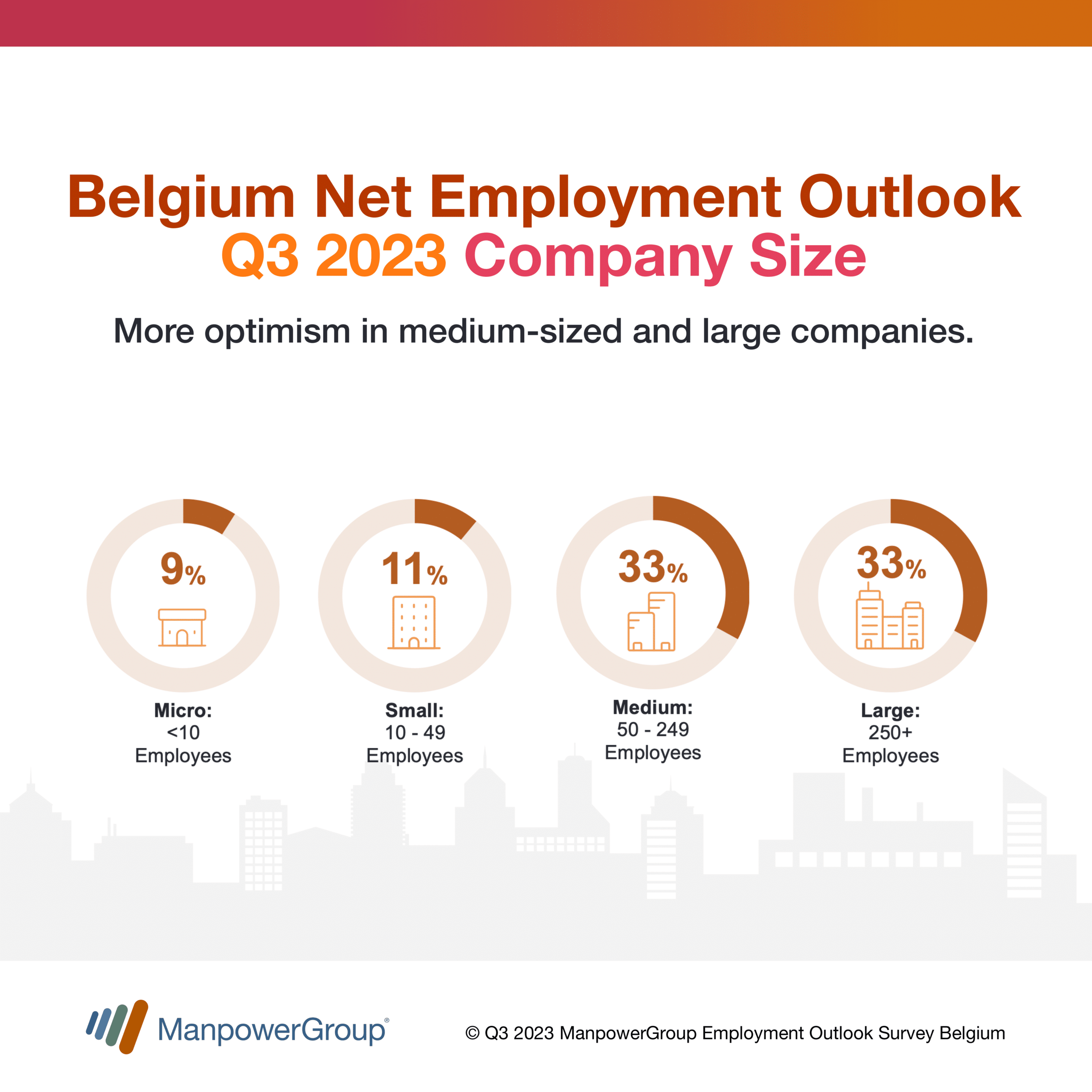

More optimism in medium-sized and large companies

According to the ManpowerGroup survey, the Net Employment Outlook is positive in all four organization sizes surveyed :+9% for micro companies (<10 employees), +11% for small companies (10-49 employees), +33% for medium companies (50-249 employees) and +33% for large companies (≥ 250 employees).

“Hiring staff is a risk and a major investment, and this is even more the case for the smallest structures. It is therefore understandable that in the current climate of uncertainty, employers in micro and small businesses are adopting a wait-and-see attitude, with only 24% and 28% respectively planning to add more staff over the next three months,” explains Sébastien Delfosse.

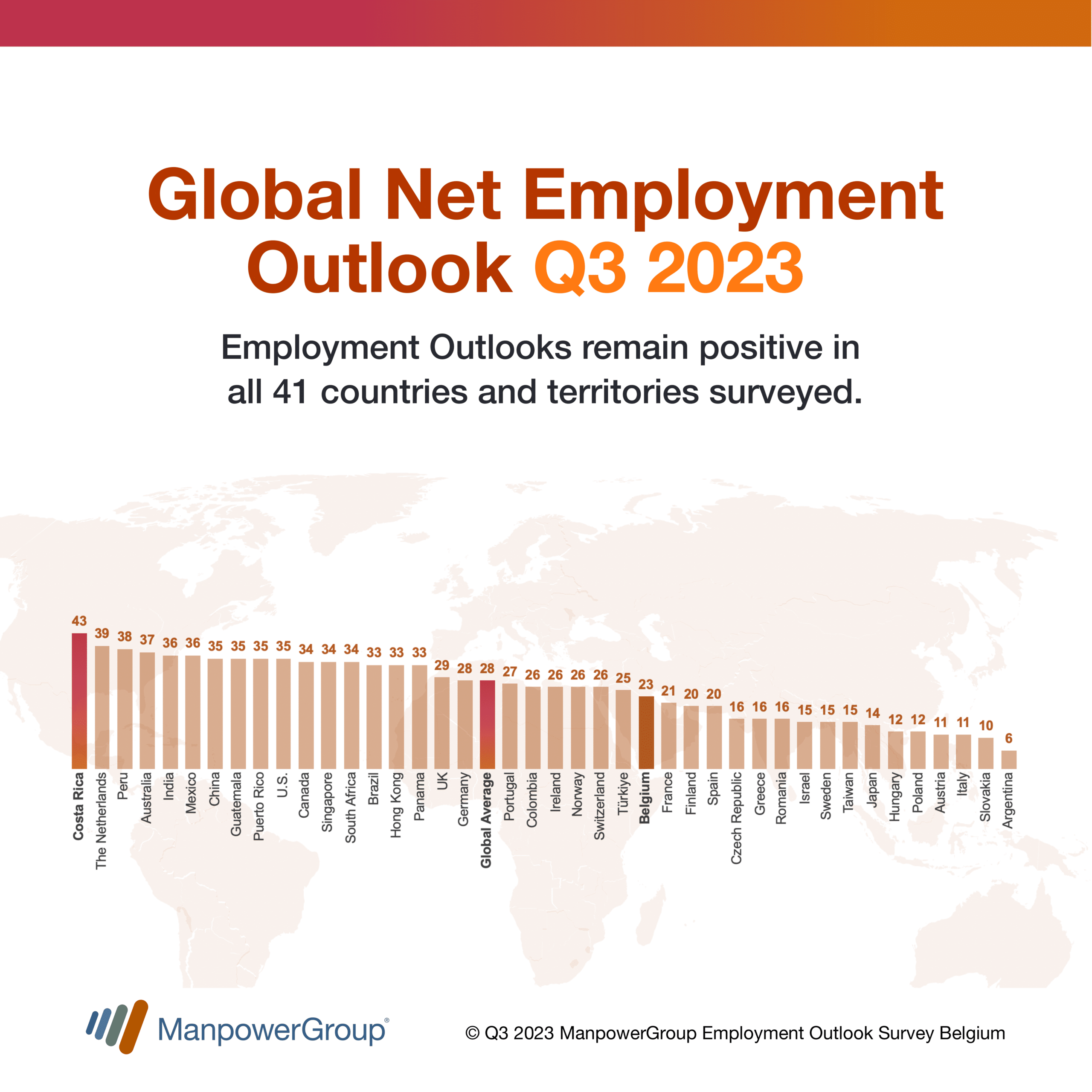

Positive employment outlook in all 41 countries and territories surveyed

At global level, hiring intentions are positive in all 41 countries and territories surveyed. Employer confidence has risen in 29 countries, while it has fallen in 11. “A comparison with the same period last year shows that employers are under pressure and that the uncertain economic environment is weighing on their hiring decisions, particularly in Europe,” analyses Sébatien Delfosse.

Employers in 26 countries report a weaker hiring outlook compared with the same period last year, improving in 12 and remaining unchanged in two.

Employers in Costa Ricca (+43%), the Netherlands (+39%) and Peru (+38%) have reported the most optimistic Outlooks, while the most pessimistic forecasts are from Italy (+11%), Slovakia (+10%) and Argentina (+6%).

With a Net Employment Outlook of +23%, Belgium is slightly above the European average (+20%), but below the global average (+28%). Belgium ranks ninth out of 24 countries in the EMEA region, far behind the Netherlands (+39%), the UK (+29%), Germany (+28%), Portugal (+27%) and Ireland (+26%), Norway (+26%), Switzerland (+26%) and Turkey (+25%), but ahead of France (+21%), Spain (+20%), Sweden (+15%), Poland (+12%) and Italy (+11%).

Elsewhere in the world, the hiring climate for the third quarter looks more favourable in India (+36%), China (+35%), the United States (+35%) and Brazil (+33%), but much more limited in Japan (+14%).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 12 September 2023 (Quarter 4 2023).

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. Net Employment Outlooks for countries and territories that have accumulated at least 17 quarters of data are reported in a seasonally adjusted format unless otherwise stated. Seasonally adjusted data are not available for Croatia.

(2) ManpowerGroup Talent Shortage Survey

Report : ManpowerGroup Employment Outlook Survey Q3/2023