Talent shortages keep Belgian hiring intentions high for Q1 2024

ManpowerGroup : ‘The future of work is huManpower’

30 October 2023

The trend of ‘Quiet Quitting’ tops the strategic priorities for HR in Belgium in 2024

8 January 2024With a Net Employment Outlook up for the third consecutive quarter at +33%, Belgian employers are showing their willingness to create new jobs in Q1 2024. According to ManpowerGroup, the difficulties encountered by three out of four employers in filling their vacancies are the reason why recruitment intentions remain at a high level.

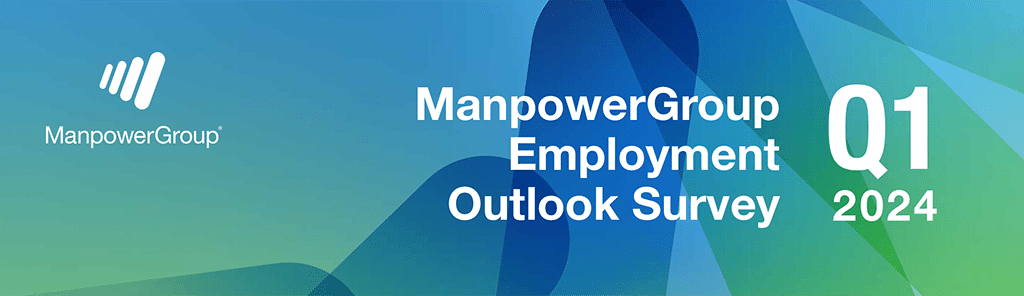

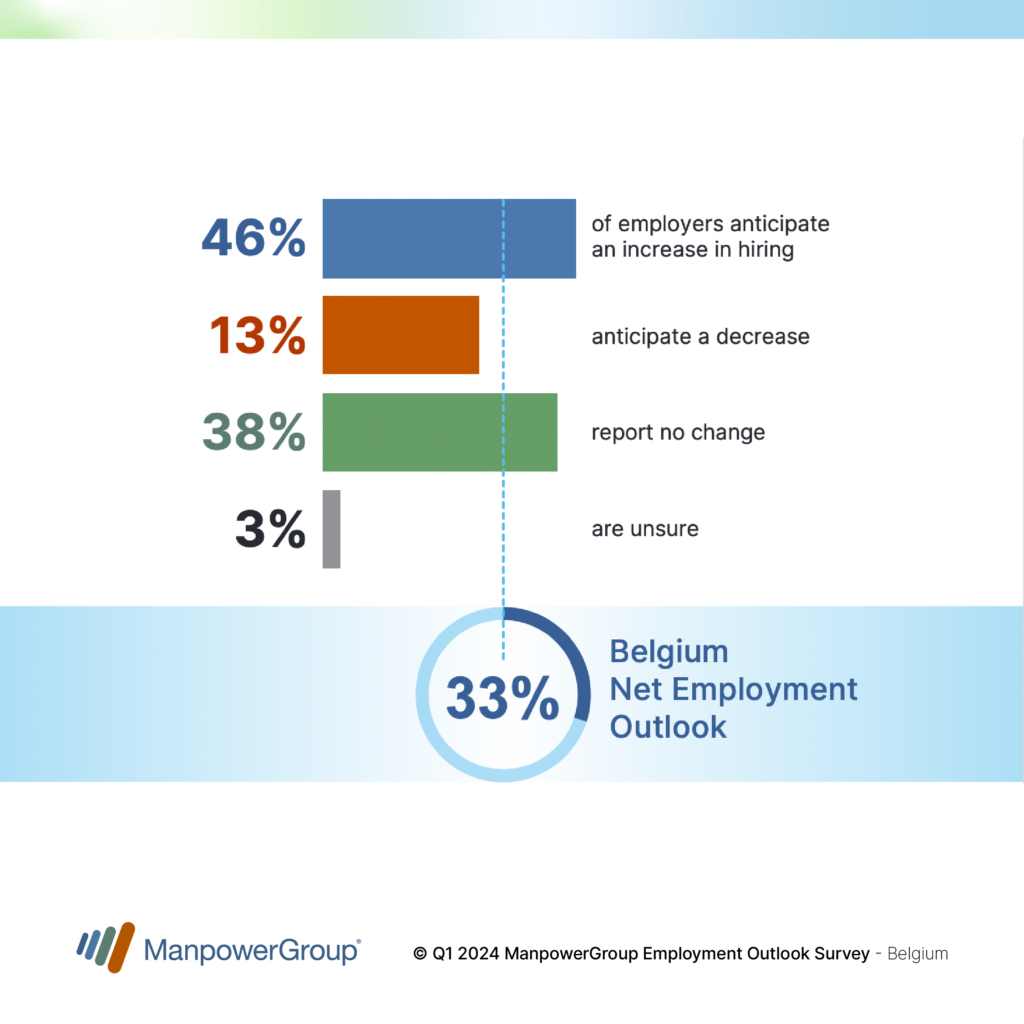

According to the ManpowerGroup Employment Outlook Survey published today, job opportunities will be available in all sectors during the first quarter of 2024. In fact, out of the 525 employers surveyed in October by ManpowerGroup, 46% plan to increase their workforce by the end of March 2024, while only 13% anticipate reductions. 38% of the employers interviewed do not anticipate any changes. After adjusting for seasonal variations, the Net Employment Outlook(1) – or the difference between the percentage of employers anticipating an increase in their staffing levels and the percentage planning to reduce headcount – stands at a positive value of +33%. This is an increase of 2 points compared to the previous quarter and 10 points compared to the fourth quarter of 2022. At the same time, talent shortages affect 74% of employers surveyed in Belgium, a decrease of 6 points compared to last March.

“Belgian employers anticipate an increase in recruitment activity for the third consecutive quarter. Belgium’s Net Employment Outlook (+33%) is 10 points above the European average (+23%), ranking our country second out of the 22 countries surveyed in the European continent, just behind the Netherlands (+37%), whereas the overall trend of our survey indicates a slowdown in hiring internationally, compared to the previous quarter,” explains Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “These positive forecasts for our country are largely due to a postponement of recruitment intentions for positions that remain open due to talent shortages and the difficulties faced by 3 out of 4 employers surveyed in finding the right profiles. In a highly uncertain context, at both the economic and geopolitical levels, employers will start 2024 by continuing their transformation and striving to retain and attract the talents they need.”

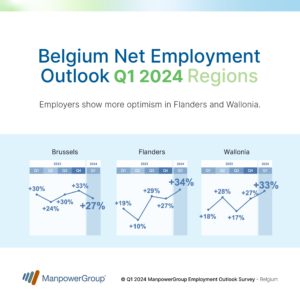

Positive Outlooks in all three regions

Employers in all three regions of the country report positive hiring intentions for the upcoming quarter: +34% in Flanders, +33% in Wallonia, and +27% in Brussels. Employment prospects are improving in Flanders and Wallonia both on a quarterly and annual basis, while the Net Employment Outlook is declining in Brussels, reaching its lowest level since the second quarter of 2022. Talent shortages remain significant in all three regions: 74% in Flanders, 76% in Wallonia, and 71% in Brussels.

Optimism among employers in the Telecommunications, IT, and Energy sectors

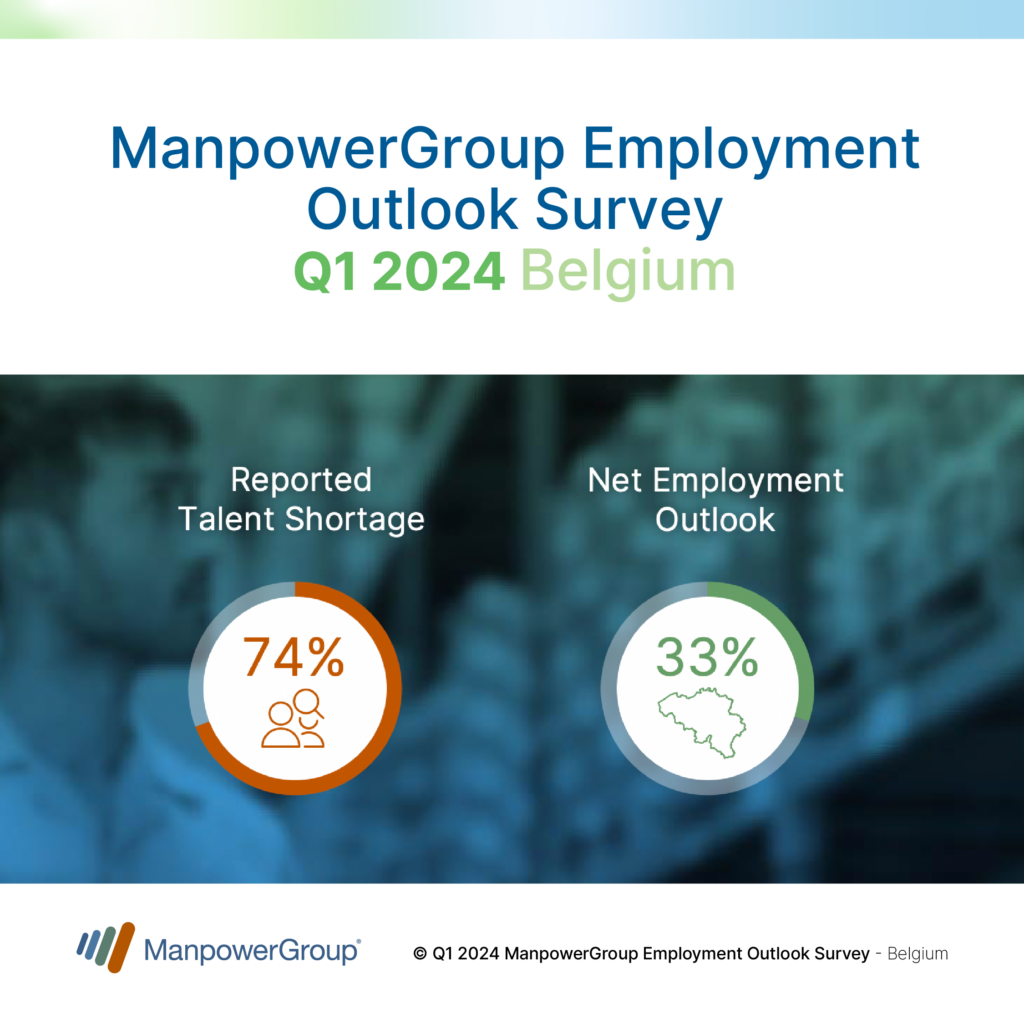

Employers across all 9 surveyed sectors plan to increase their workforce by the end of March 2024.

Recruitment activity is expected to be particularly strong in three sectors: Telecoms (+51%), where nearly six out of 10 employers anticipate hiring in the next three months, IT (+49%), and Energy (+43%). Employers in these three sectors also face challenges in filling vacant positions, with 76% of employers in the Telecoms and Energy sectors and 73% in the IT sector reporting difficulties. Hiring intentions are also quite favorable in the Finance and Real Estate sector (+36%), Healthcare/Life Sciences (+34%), and Manufacturing Industry & Construction (+34%). However, recruitment activity is expected to be lower in the Public Services/Non-profit/Education/Other sector (+21%), Transport/Logistics/ Automotive (+19%), and Consumer Goods/Services/Hospitality/ Retail sector (+8%).

According to the ManpowerGroup survey, employers in the Public Services and Non-profit, Education sector, show the highest positive intentions (83%).

Since the 4th quarter 2023, recruitment intentions have been on the rise in 4 out of the 9 surveyed sectors and declining in the remaining 5. In comparison to the first quarter of 2023, the hiring climate has improved in 5 sectors and weakened in 3 others.

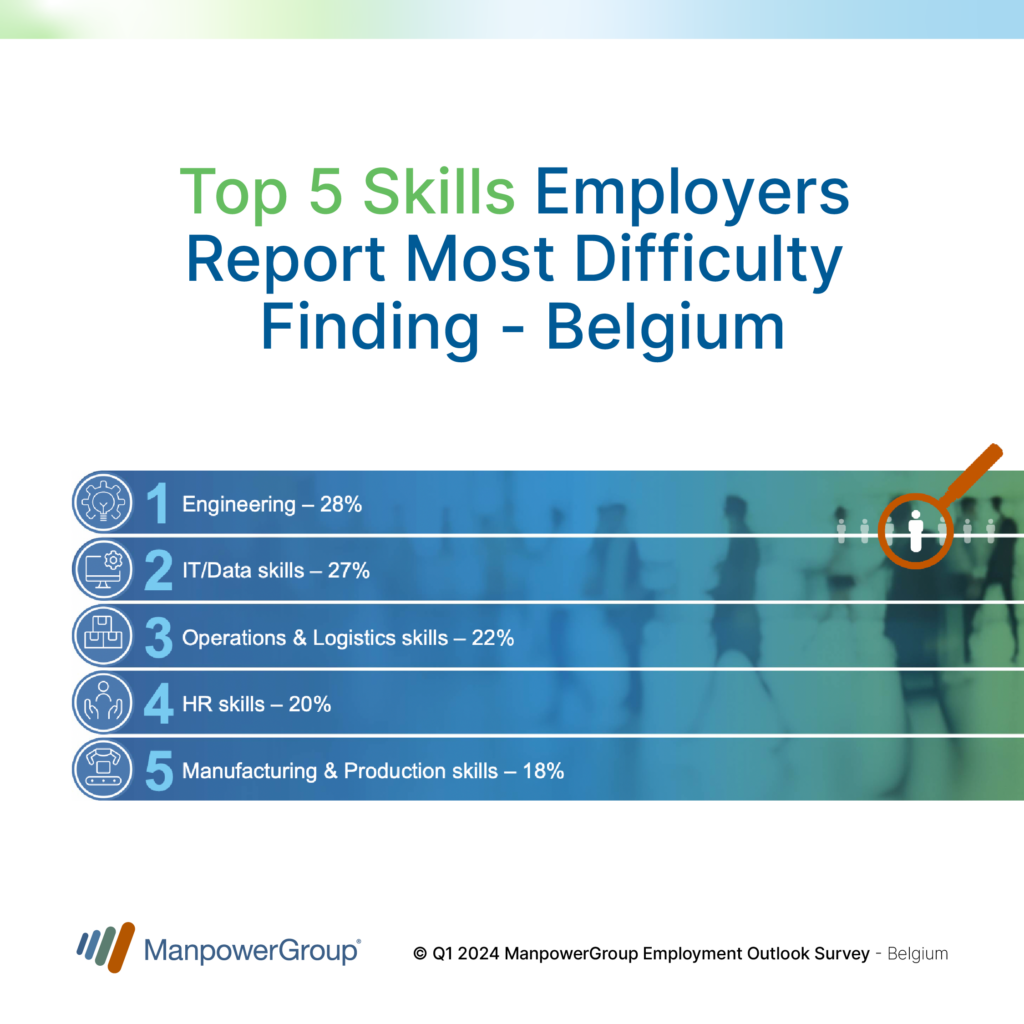

Seeking engineers/technicians and IT specialists

Companies continue to face great difficulty finding certain profiles. Engineers and technicians (28%), IT/Data positions (27%), and logistics positions (22%) top the list, followed by HR (20%) and Manufacturing (18%), according to a ranking established by ManpowerGroup. “Despite the unfavorable economic environment, employers across all surveyed sectors are under pressure to find the profiles they are looking for, and recruiters observe the persistent mismatch between the supply and demand for skills every day,” notes Sébastien Delfosse. This situation is confirmed by the latest figures from the Belgian Office Statbel(2) – which revealed that the job vacancy rate in the second quarter of 2023 – the number of vacant jobs compared with the total number of positions within the company – remains very high at 4.63%, representing 194,957 unfilled positions, with 67.36% in the Flemish Region, 19.69% in the Brussels Capital Region, and 12.95% in Wallonia.

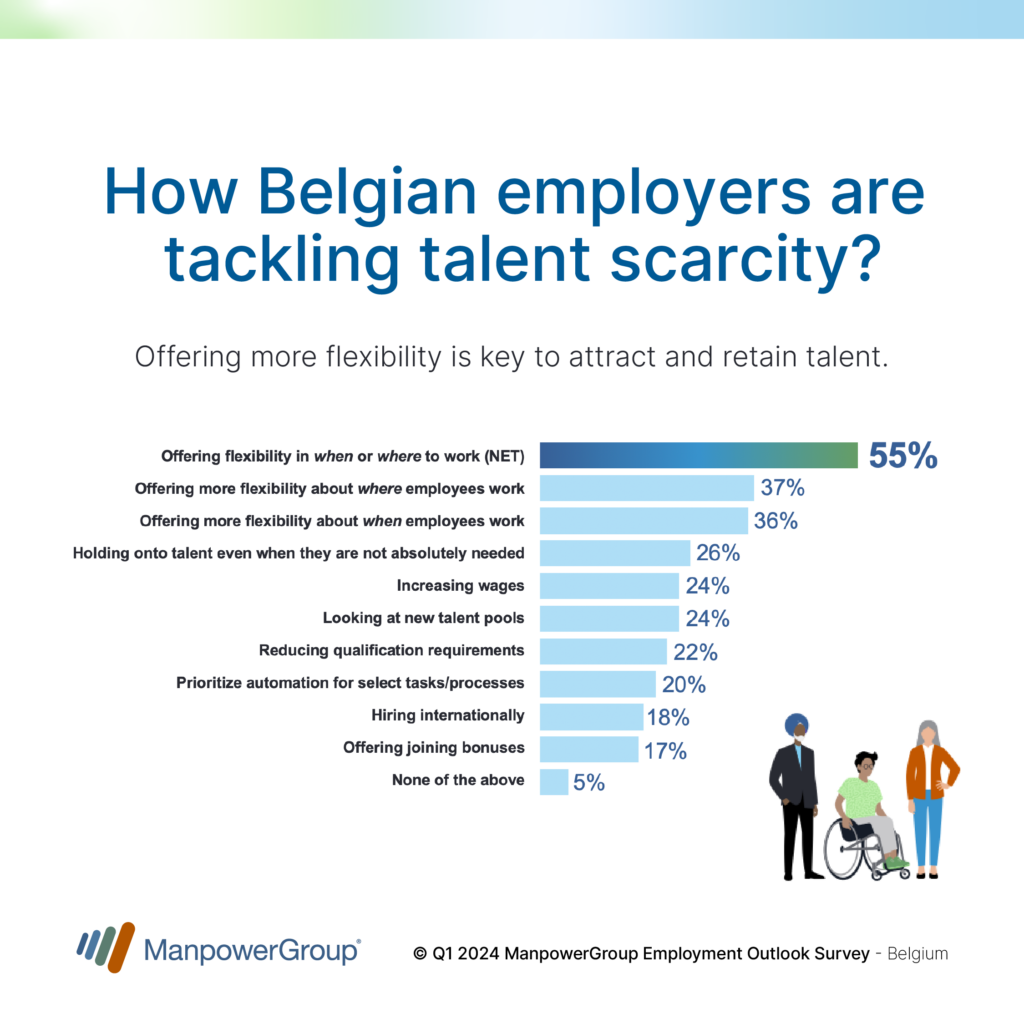

Flexibility: Best Way to Attract and Retain Talent

In the current labor shortage context, employers are doubling down on efforts and creativity to attract and retain talent. Unsurprisingly, flexibility (55%) emerges as the primary action chosen by employers, whether it involves flexibility in the workplace – office work, hybrid, or remote work (37%) – or flexibility in terms of working hours (36%). “Flexibility in working hours and remote work is one of the top topics discussed by candidates during a job interview,” adds Sébastien Delfosse. Among other selected actions, employers mentioned the decision to ‘retain talents even if not absolutely necessary in the short term’ (26%), salary increases (24%), expanding the candidate pool through diversity-related initiatives (older workers, etc.) (24%), reducing required qualifications at the time of hiring (22%), prioritizing the automation of certain tasks or processes (20%), or recruiting beyond borders (18%).

International Hiring Slowdown

Despite a decline in recruitment intentions compared to the previous quarter in 32 out of 41 countries and in 16 out of 24 countries in the EMEA region (Europe, Middle East, Africa), the Net Employment Outlook remains positive in all surveyed countries. It stands at +26%, down 4 points on the previous quarter, but up 3 points on last year. Employers in India and the Netherlands are the most optimistic (+37%), while their counterparts in Argentina are the most pessimistic (+2%).

With a Net Employment Outlook of +33%, Belgium is 10 points above the European average (+23%). Our country ranks second out of 24 in the EMEA region, behind the Netherlands (+37%) but on a par with Switzerland (+33%) and ahead of Germany (+30%), the United Kingdom (+27%), France (+20%), Spain (+19%), Poland (+18%), and Italy (+13%).

Elsewhere in the world, employment prospects are fairly positive in the United States (+34%) and China (+33%) but remain very low in Japan (+10%).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 12 March 2024 (Quarter 2 2024).

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. Net Employment Outlooks for countries and territories that have accumulated at least 17 quarters of data are reported in a seasonally adjusted format unless otherwise stated.

(2) Statbel : number of job vacancies in Belgian enterprises in the 2nd quarter 2023. https://statbel.fgov.be/en/themes/work-training/labour-market/job-vacancy